November 15, 2024

What We’re Focused on Post-Election

After what looked to be an incredibly close Presidential race with more than its share of surprises, former President Trump has been elected for a second term. The Republican party gained control of the Senate, and as of this writing, Republicans tallied just enough votes to maintain control of the House.

U.S. Stock markets rallied following the election with both small and large-cap indices up single digits, while international developed and emerging market stocks fell. Bond yields pushed higher in the U.S. while the U.S. Dollar gained strength. The market reaction was very similar to its reaction eight years ago and is a bit of a déjà vu from 2016.

With the potential for less gridlock with the new administration, what are the priorities of President Trump and the Republican party looking into 2025?

Fiscal Policy

One of the biggest items on the agenda for the new year is the expiring spending and tax provisions that were enacted in the tax cut and jobs act of 2017. These tax cuts will expire at the end of 2025 and need to be extended by congress if these tax cuts are to be maintained into the future. Strategas estimates that 2025 could be the largest year for tax policy since 1913 as there are nearly $4 trillion in provisions that will be sunsetting if no action is taken.[1]

- Other priorities mentioned on the campaign trail for personal income taxes include eliminating federal income tax on social security payments, overtime and service tips. If implemented, these policies have the potential to increase disposable income for consumers which could spur further consumption.

- Trump also discussed his desire to lower the corporate income tax rate from 21% to 15%; this has the potential to increase corporate profitability.

Regulation

Trump has indicated a desire to roll back regulations on several industries including but not limited to, oil & gas, banks, crypto and automobiles.

Trade Policy

The Biden administration largely retained tariffs that were implemented during Trump’s first term. Trump would like to further increase tariffs broadly, and particularly increase tariffs on Chinese exports in an effort to develop additional manufacturing in the U.S.

Immigration

Trump intends to increase border enforcement and limit sources of immigration into the U.S.

In Fulcrum’s previous post in this election series, we discussed some of the benefits of a gridlocked government as there are challenges in passing sweeping changes to current policy which can in many ways be a feature of the US government’s structure. With a Republican sweep, it changes this dynamic as there will be less checks and balances to restrain broad changes in policy. This could eventually lead to volatility as the scope of policy uncertainty increases. Yet volatility and changes in policy may also present investment opportunities as those changes in the landscape can lead to growth in certain segments of the market.

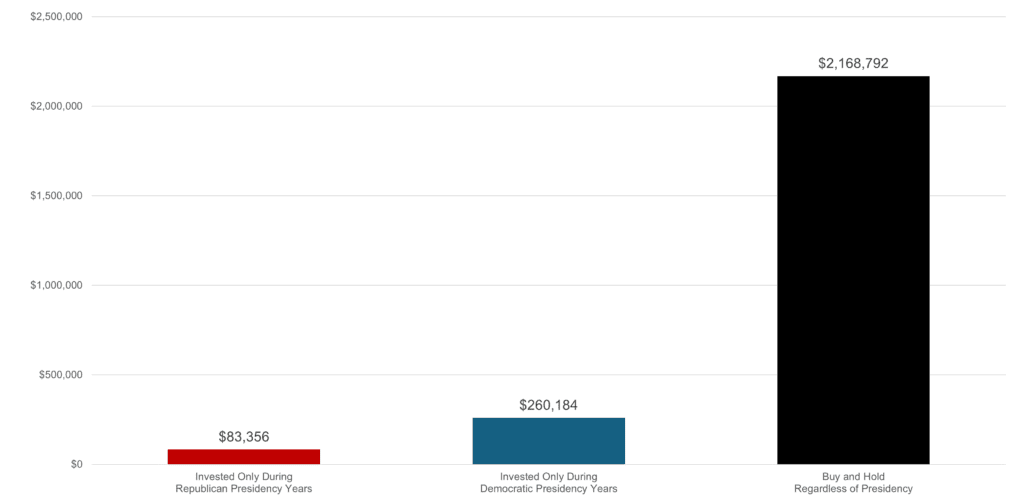

It’s also important to remember that although public policy can create headwinds or tailwinds to growth, broader economic factors at play can be a bigger driver of markets over the long-term. The US economy continues to exhibit positive GDP growth with strong consumer spending. The US labor market is at historically low unemployment levels and experiencing real wage growth, and the Federal Reserve is shifting to a more accommodative policy with short-term rates dropping a further 0.25% two days after the election. Regardless of what political party is in power, it’s important to stick to your financial plan and invest for the long-term. There’s potentially a heavy cost to sitting out of the markets if you only invest when your preferred US political party is in power.

Growth of $10,000 Invested in the S&P 500 Since 1953

Source: Bloomberg, Goldman Sachs Asset Management. Chart shows hypothetical growth of $10,000 invested into the S&P 500 from 1953 through 2024. Invested only during Republican or Democratic years represents investing only when the specific party takes control of the presidency and selling out of the position whenever the opposite party takes control. For illustrative purposes only. Data as of September 30, 2024.

Markets quickly reacted to potential policy changes, but until those policy specifics are shaped and clarified, we aren’t making broad changes. We’re closely monitoring developments as policies are proposed and implemented and will be ready to take advantage of changes that may provide opportunities.

One of our roles is to serve as a guide through changes. Please reach out to your advisor if you have concerns about the impact of the election outcome on your own financial situation. We’re here to help.

[1] Strategas, 2024 Election Advisor Briefing, October 2024

This report is limited to the dissemination of general information pertaining to Fulcrum Capital, LLC, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations and investment strategies differ based on a variety of factors. This information is subject to change without notice. Fulcrum Capital, LLC is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.