January 27, 2022

The Party is Over

by Tim Clark

Inflation and the Pandemic

The story of 2021 was the success of vaccines and the reopening of global economies. Global real GDP for the year was just under 6% according to the IMF, and global stocks responded by gaining 18%. Heading into 2022, the story shifted toward the challenging combination of inflation and the Covid-19 Omicron variant.

The U.S. Consumer Price Index, a measure of inflation for urban consumers, posted nine straight months above 4%, ending the year at 7%, the highest in almost 40 years. The pandemic has certainly played a part in higher prices, driving supply chain bottlenecks, changing consumption patterns, and unprecedented government aid and stimulus. We believe these pressures will ease into the second half of the year, taming inflation somewhat, but, strong wage growth, accelerating rents, and buoyant commodity prices will likely keep it elevated. We expect wages and rent will stabilize by 2023, but there is a remaining wild card: commodity prices, notably oil. More on this below. We still assert that U.S. inflation will settle back to the 2.0 – 2.5% range over the medium-term. Disinflationary forces such as aging demographics, high fiscal debt levels, stagnant economic activity, and technological innovation will keep a lid on inflation over the longer-term.

Just as the world was looking forward to “life as normal” at the end of 2021, the new Omicron variant surfaced. The new variant has most likely delayed the global economic recovery in the first quarter, but we believe the long-term impacts will likely be benign. It’s possible that Omicron’s higher transmissibility and lower rate of severe infections could actually benefit the global effort to combat the virus by building herd immunity and catalyzing more “anti-vaxxers” to get vaccinated. We are optimistic, and we hope not naively so.

Buckle up for volatility

We have entered 2022 with a more cautious stance. The metaphorical “punch-bowl” for the past several years has been the extraordinary fiscal and monetary stimulus implemented to stave off a massive global recession driven by the pandemic. This “punch-bowl” is swiftly being replaced with rising interest rates, higher taxes, and lower government spending. The spending party has led to a hangover for risk assets, specifically stocks and bonds. Many governments around the globe are pulling back fiscal stimulus and dialing back the massive deficits that followed the initial outbreak of Covid-19. As economies recover, central banks, notably the U.S. Federal Reserve (the Fed), have pivoted toward less-accommodative interest rates. The Fed’s mandate is price stability, not economic growth, and the tight labor market is prompting Fed officials to accelerate their efforts to reduce inflation. The result is the higher volatility we have experienced year-to-date and we expect that volatility continue throughout the year.

Volatility tends to increase in election years, and we expect high-stakes politics in Washington D.C. and abroad will also drive markets this year. This mid-term election year may well end with control of the House and potentially the Senate, changing parties in November. Moreover, geopolitical tensions between the West and Russia and China will also drive volatility, particularly in oil prices. However, we believe a full-scale war over the Ukraine or Taiwan is a low probability event.

2022 Investment Strategy

For long-term investors, we remain slightly overweight stocks relative to bonds, favoring high-quality companies, select cyclical sectors (i.e. oil), and international markets. While we expect a positive backdrop for earnings and growth, we also believe higher inflation and the ensuing increase in interest rates will continue to compress global stock valuations. We see the speculative growth and meme stocks as the most vulnerable in this environment.

Publicly-traded bonds are expected to be challenged in the face of higher inflation and interest rates. At the end of last year, we modestly reduced our public bond allocations to reflect these future headwinds, while at the same time increasing exposure to private credit, which typically responds more favorably in a rising interest rate environment.

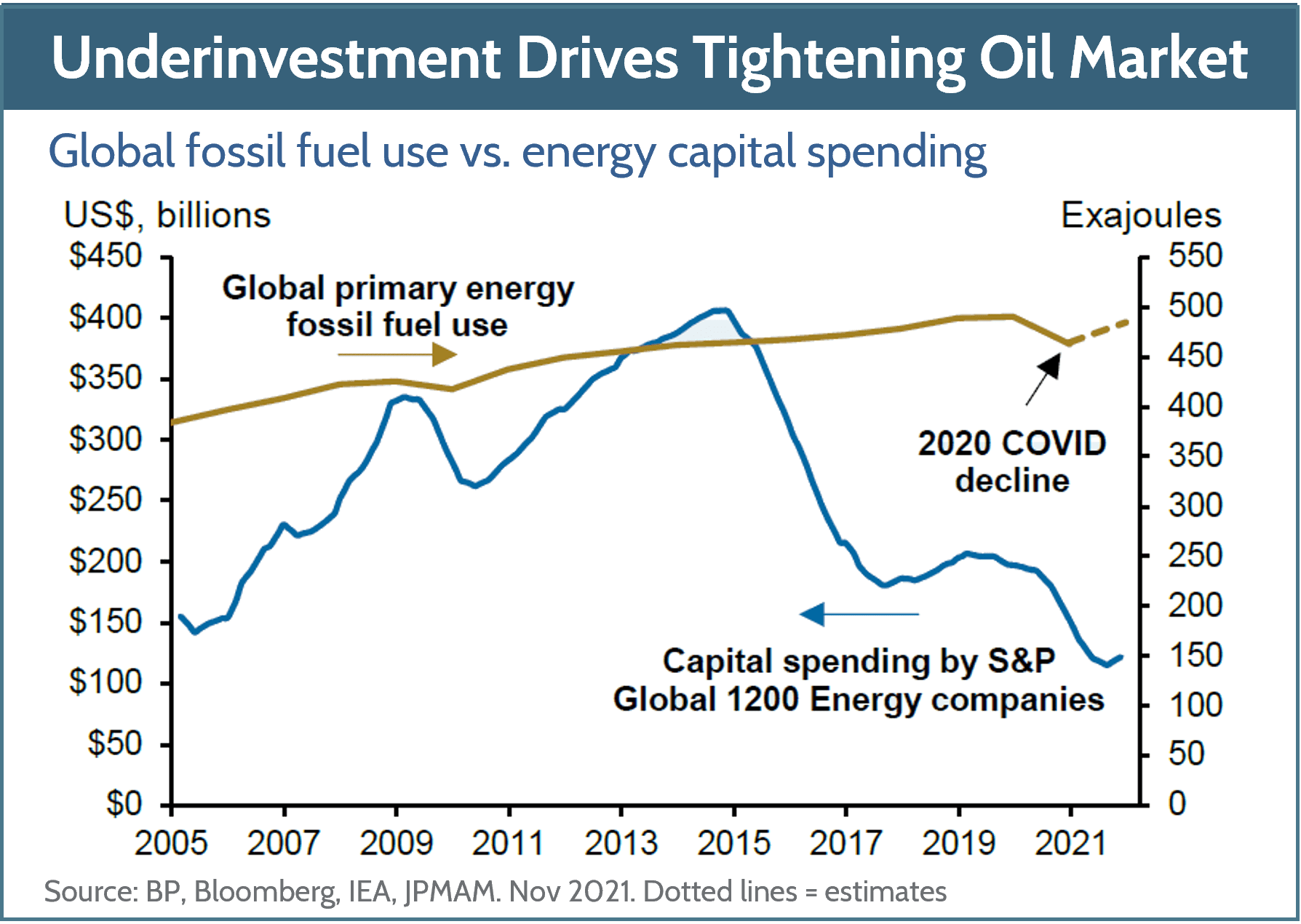

We remain committed to our investment strategy of owning high-quality companies that have pristine balance sheets, are dominant in their respective industries, and continue to grow sales, earnings, and dividends. There are also investment opportunities in some cyclical sectors, notably oil. The oil market is on track to be the tightest in decades due to years of underinvestment. OPEC and Russia are projected to run out of spare capacity over the next several years and U.S. shale producers, known for their ability to bring new supply online quickly, have shown capital discipline. Their response to higher prices has been more muted than in the past. We believe sustained higher prices will be required to bring supply online gradually or take a bite out of demand. This backdrop is supportive of oil stocks.

Last year was another exceptional year for U.S. stocks. The S&P 500 index posted 70 new highs in 2021 and rallied 28.7% for the year, driven by unprecedented fiscal and monetary stimulus and a 29% surge in corporate profit margins. International stock markets were mixed in 2021. Europe struggled with more Covid-19 outbreaks and travel restrictions, while China’s regulatory and real estate woes dragged down emerging markets. Foreign developed stocks gained 14.8%, while emerging markets dropped 2.5%.

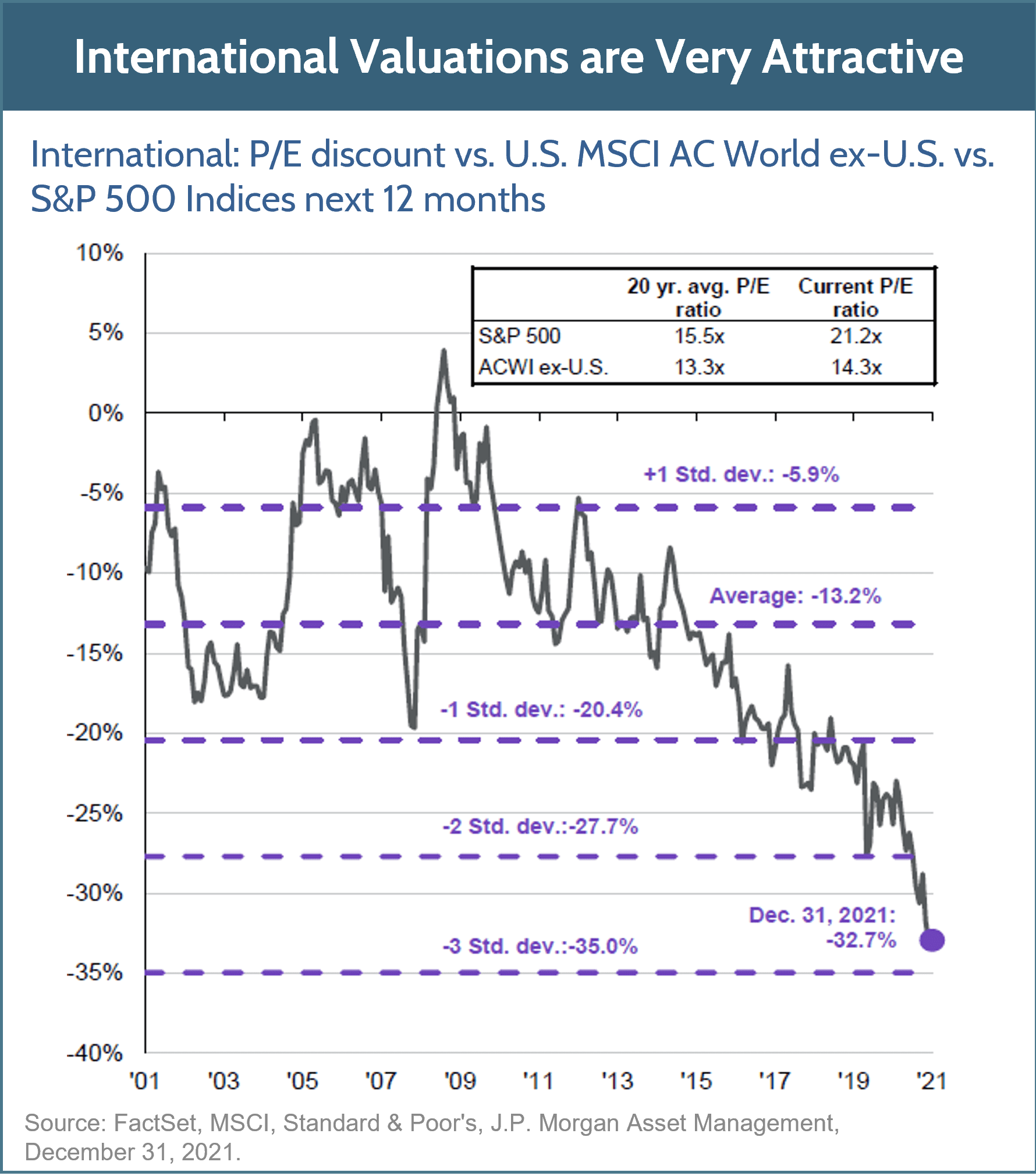

2022 may be the first year since 2012 that foreign and emerging markets outperform the U.S market. And we wouldn’t be surprised if the trend persists. Many forget that foreign stocks outperformed the U.S. for the better part of the 2000’s. The economic backdrop is more favorable for non-US stocks and stock valuations are ridiculously cheap. Japan and continental Europe continue to garner fiscal and monetary support and have higher vaccination rates and fewer issues with labor and wage inflation than the U.S. The Chinese government and its central bank also have an accommodative stance coming into 2022, although a softening property market, tightening regulations, and a zero-Covid policy have us less optimistic about China compared to Europe and Japan. Although risks remain elevated, China is still a region experiencing meaningful growth and value.

By 2025 or so, we expect the global economy to return to a regime similar to pre-Covid: low growth, low inflation, high debt, and negative real interest rates. This environment will be supportive of higher values for growth stocks, real estate, private credit, and other risked-assets.

We recommend investors avoid overreacting to volatility as the changing monetary policy and political backdrop could inject more uncertainty into markets throughout the year. Rather, by centering our attention on the long-term, we can navigate these volatile markets and take advantage of the ensuing price dislocations. Fulcrum’s investment team, like many active investment managers, embrace volatility. Times of market volatility allow us to bring added value to our clients by navigating the markets, reminding clients to step back and keep an eye on the long-term, and ensuring their plan is in line with their values.

Thank you for trusting us to guide you through the good times and the bad. Our responsibility to our clients is always on our minds. Please don’t hesitate to reach out to your team with questions about your investments or the impact of this volatility on your portfolio and financial plan. We are here to help you.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.