April 11, 2022

Market Review: Q1 2022

By Tim Clark

After an extraordinary 2021, the first quarter of 2022 has been challenging for financial markets. Anxieties over the Russian invasion of Ukraine and the prospect of faster interest rate hikes to fight high inflation weighed heavily on both stocks and bonds. The ensuing global sanctions against Russia exacerbated global inflation by creating more supply chain disruptions and a surge in energy and commodity prices. Central banks, notably the U.S. Federal Reserve, are facing a choice between combatting inflation or supporting economic growth.

It appears inflation is an urgent problem here at home. U.S. inflation has been far more persistent and broad-based than anticipated, with inflationary pressures extending beyond durable goods to core services, wages, and, more recently, energy. These data points are forcing the Federal Reserve to ratchet up interest rates materially to keep inflation from spiraling out of control.

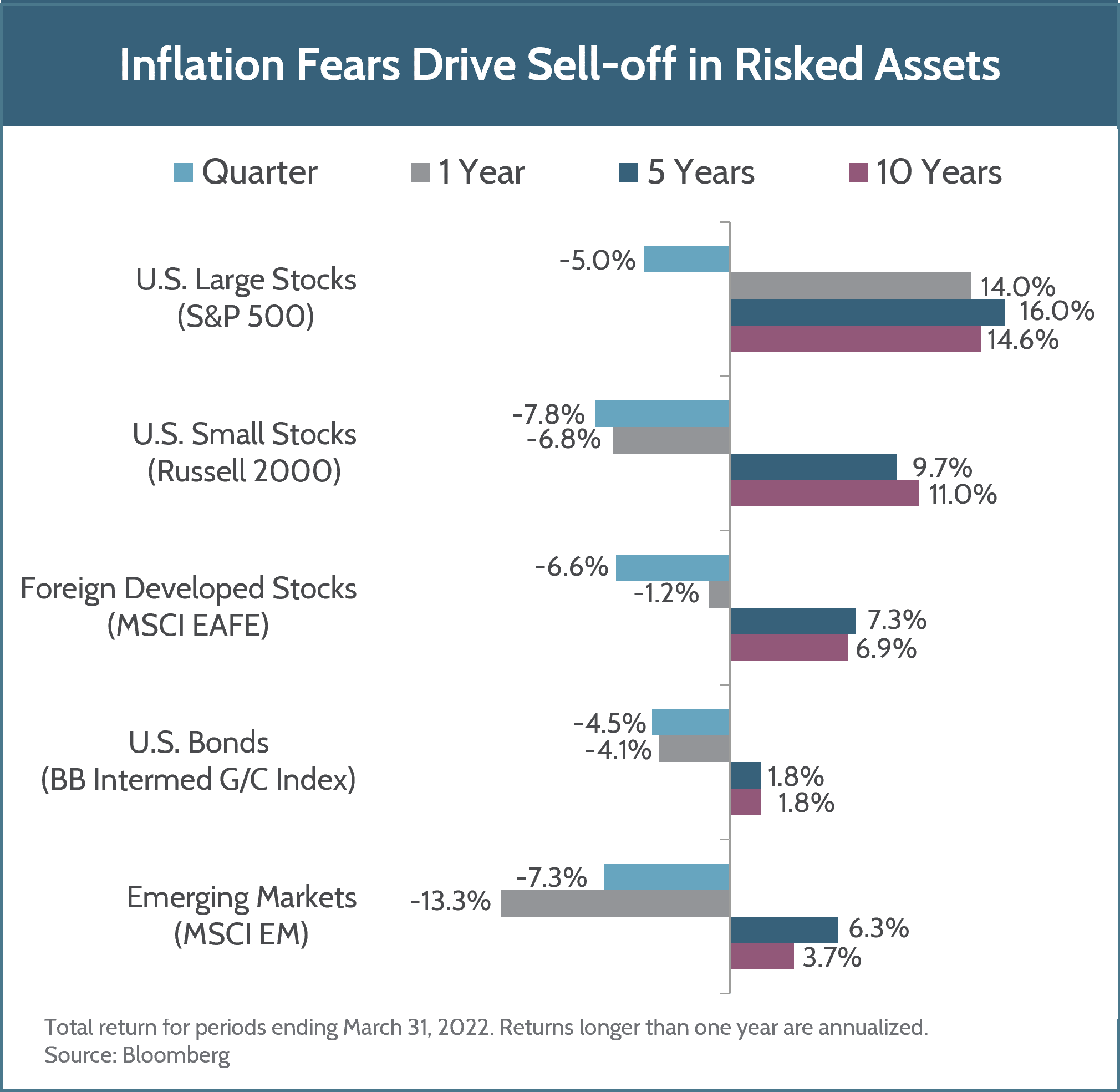

Over the quarter, global stock markets were all down due to the threat of higher rates. U.S. large cap stocks ended the quarter down 5%, but at one point were down over 13% from the peak of January 3, 2022. The tech-heavy NASDAQ composite fared even worse, down almost 21% from January 3. U.S. small cap stocks ended the first quarter 7% lower.

Foreign developed stocks also were pulled lower, down close to 7%, with the Ukraine war exacerbating the sell-off. Not only was the war on continental Europe’s eastern flank, but the region also relies heavily on Russian energy, especially natural gas. Emerging market stocks registered a 7.3% negative return in the quarter as geopolitical tensions took center stage. Russian equities and the ruble plummeted following the invasion. Risk aversion impacted other emerging European markets, specifically those of Hungary and Poland, which also fell sharply. Rising energy prices were also a headwind for emerging market net importers, notably India.

The U.S. bond market suffered its worst quarterly performance since the third quarter of 1980, with investment-grade intermediate bonds down 4.5%. There was truly no place to hide, as even the safe haven 6-month Treasury Bill index lost 0.1% for the quarter.

We may experience slightly smoother sailing over the next several months than we experienced in the first quarter. It appears to us that financial markets have mostly recalibrated to the new reality of higher interest rates. Looking to history as a guide, we see that the stock market typically grinds higher in the early stages of an interest rate hiking cycle. However, looking out more than a few months, market performance becomes harder to predict, especially if inflation remains too high. The second half of the year could be very similar to the start: higher volatility and lower returns. Here at Fulcrum, we are building client portfolios to weather a range of outcomes while taking advantage of the opportunities that volatility can offer. Please reach out to your advisor if you have questions or concerns about market volatility and its impact on your financial plan.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.