January 3, 2025

Market Review: 4Q 2024

Investors started 2024 with high hopes, anticipating continued GDP growth, slowing inflation, a more accommodative Fed, and climbing corporate profitability in the year.

2024 largely delivered on those expectations.

- Real GDP in the US continued to show solid signs of growth. In the third quarter alone, real GDP expanded by 3.1% on an annualized basis led by consumer spending, federal government spending, and non-residential fixed investments.

- Headline inflation continued to dissipate, falling to 2.7% year-over-year as shelter costs showed signs of easing, and core goods & energy prices fell.

- The Federal Reserve, after holding the Federal Funds rate steady at 5.5% for over a year, started cutting the Federal Funds rate in September 2024 and continued to cut through December, ending the year at 4.5%.

- Earnings and sales growth for the S&P 500 grew at a solid pace over 2024, with companies generally beating expectations.

- The US unemployment rate ticked up incrementally over 2024 to 4.2%, which remains low by historical standards, while jobless claims and layoffs were muted. Real wage growth was positive as average hourly earnings outgrew headline inflation.

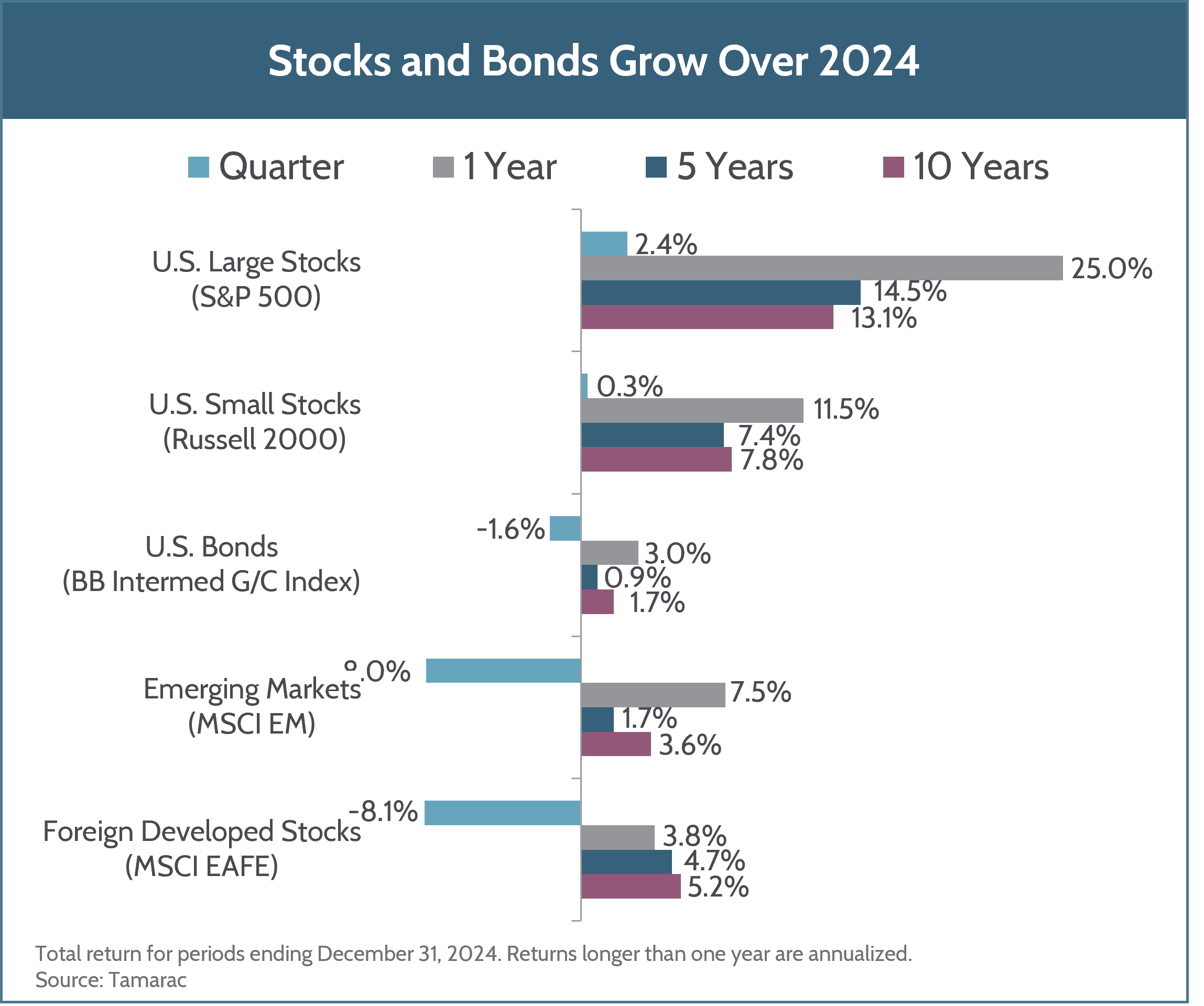

Stock and bond markets reacted in kind as US large-cap stocks climbed 25%, US small-cap stocks gained 11.5%, and bond markets were up for the year. Intermediate-term bonds posted a total return of 3% – the second year in a row that bonds delivered positive returns after difficult years in 2021 and 2022. US large-cap stocks posted back-to-back years of +25% (2023 & 2024) for the first time since the late 1990s, with growth stocks leading the way, outperforming value stocks over both years.

In the fourth quarter, US stocks continued their upward trajectory as investors priced in potential boosts to growth and corporate profitability from a Trump presidency that could likely focus on tax cuts and deregulation. On the other hand, international markets started to reflect concerns about the potential impacts of a more aggressive foreign trade policy with international developed and emerging markets stocks falling 8% over the fourth quarter. Although bonds delivered positive results for all of 2024, they also lost value in the fourth quarter as the Fed indicated that the pace of rate cuts will likely slow into 2025, putting upward pressure on rates. Longer-term rates, measured by the 10-year Treasury, ticked higher to end the year at over 4.5%.

As we start the new year, the same drivers of returns in 2024 will likely still hold merit: inflation, interest rates, and corporate profitability. However, lofty valuations leave little room for error in meeting investor expectations. And as we head into a new presidential administration, the impacts of large policy changes have the potential to move markets and create volatility. We maintain a long-term view, investing in profitable, high-quality businesses, and continue to look for opportunities, as volatility brings risks but also has the potential to create rewards.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, LLC, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators for a particular investment area, such as the S&P 500® Index serving as a way to gauge the performance of U.S. Large Stocks generally. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital, LLC is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.