January 5, 2022

Market Review: 4Q 2021

by Tim Clark

The volatility of risk assets such as stocks intensified in late November with the emergence of the COVID-19 Omicron variant. This new strain, which coincided with the arrival of winter and more time spent indoors, spurred renewed economic worries and triggered a wave of selling. Later in December, it appeared that Omicron, while significantly more transmissible, was also less deadly than the Delta strain that wreaked havoc across the globe last summer.

This said, we believe Omicron will likely delay full economic reopening with notable impacts to supply chains and inflation. We continue to believe that these supply chain issues will resolve as the economy fully reopens as we expect it to in the second half of 2022. However, inflation pressure is broadening outside the supply chain. Rental and wage inflation driven by record high U.S. real estate prices and worker shortages may be more structural in nature. We are preparing for multiple outcomes as more data becomes available. Historically low inventories and years of underinvestment may keep oil prices well above pre-pandemic levels, keeping additional upward pressure on inflation.

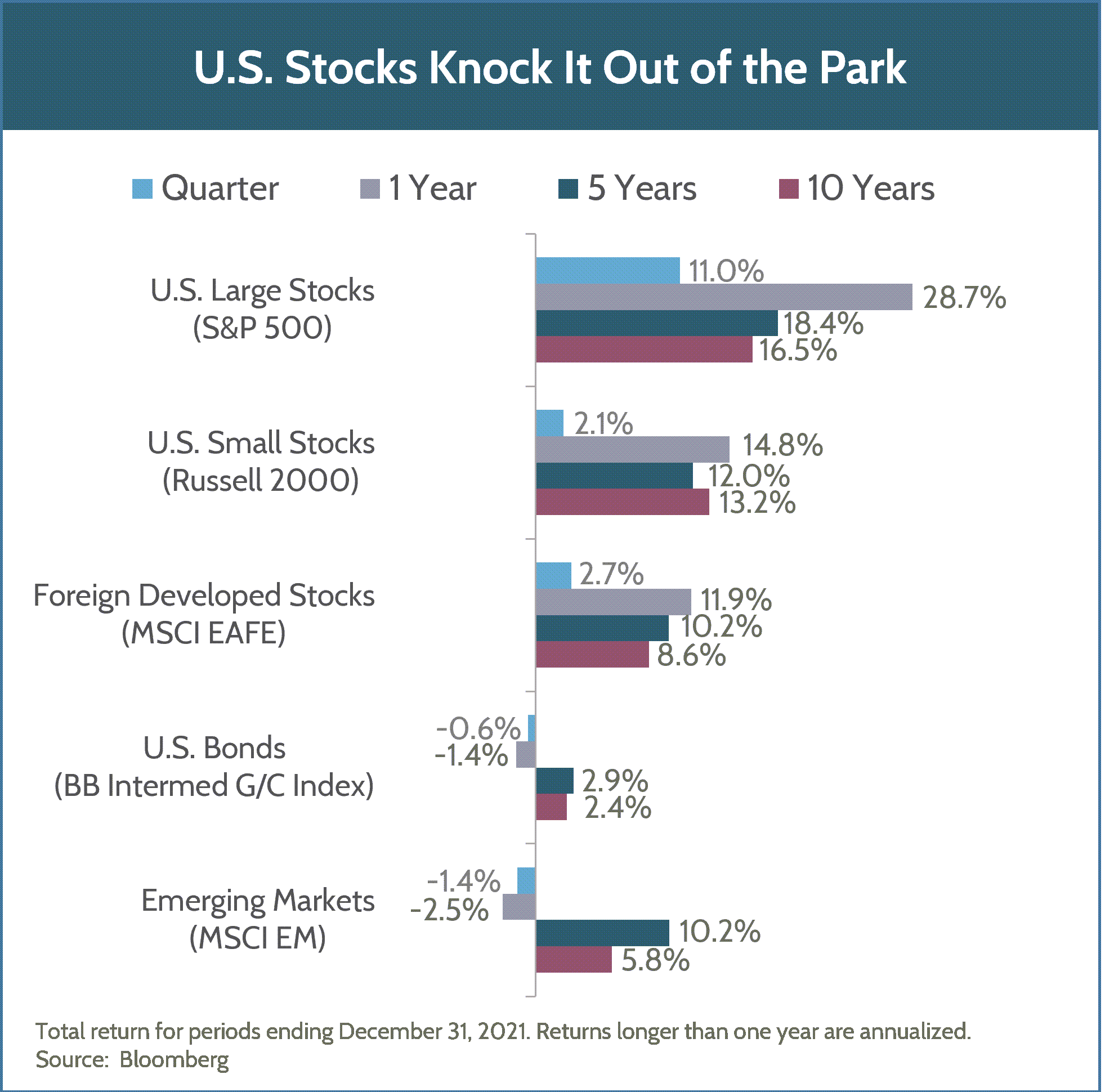

Notwithstanding the advent of Omicron, U.S. large cap stocks had an exceptional fourth quarter, returning 11.0% for the quarter. For 2021, U.S. large caps rallied 28.7%, driven by unprecedented fiscal and monetary stimulus and a U-turn in corporate profit margins. In our view, these tailwinds are likely to turn into headwinds for U.S. stocks in 2022 as stimulus fades and companies find it harder to pass along cost increases.

International stock markets were a mixed bag for the quarter. Foreign developed stocks remained in the black, up 2.1% for the quarter as French and U.K. stock markets offset negative performance out of Japan. Emerging markets were negatively impacted for the final quarter driven by continued weakness in Chinese markets. We expect Japan and the Asia Pacific Region, notably China, to fare much better in 2022 relative to U.S. markets. More supportive fiscal and monetary policy and a less restrictive regulatory environment should provide a better backdrop for the region in 2022.

U.S. bonds were 0.6% lower for the quarter as interest rates rose in anticipation of future central bank policy tightening. The asset class was down 1.4% for 2021.

We continue to recommend our clients remain broadly diversified across asset classes and regions for 2022. Please keep a look out in the coming weeks for our 2022 Outlook for more detail on our thoughts of the investment landscape.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.