October 3, 2024

Market Review: 3Q 2024

With signs of inflation moderating and a labor market easing, the Federal Reserve lowered rates in September after over a year of maintaining rates at the highest level the U.S. has seen in over two decades.

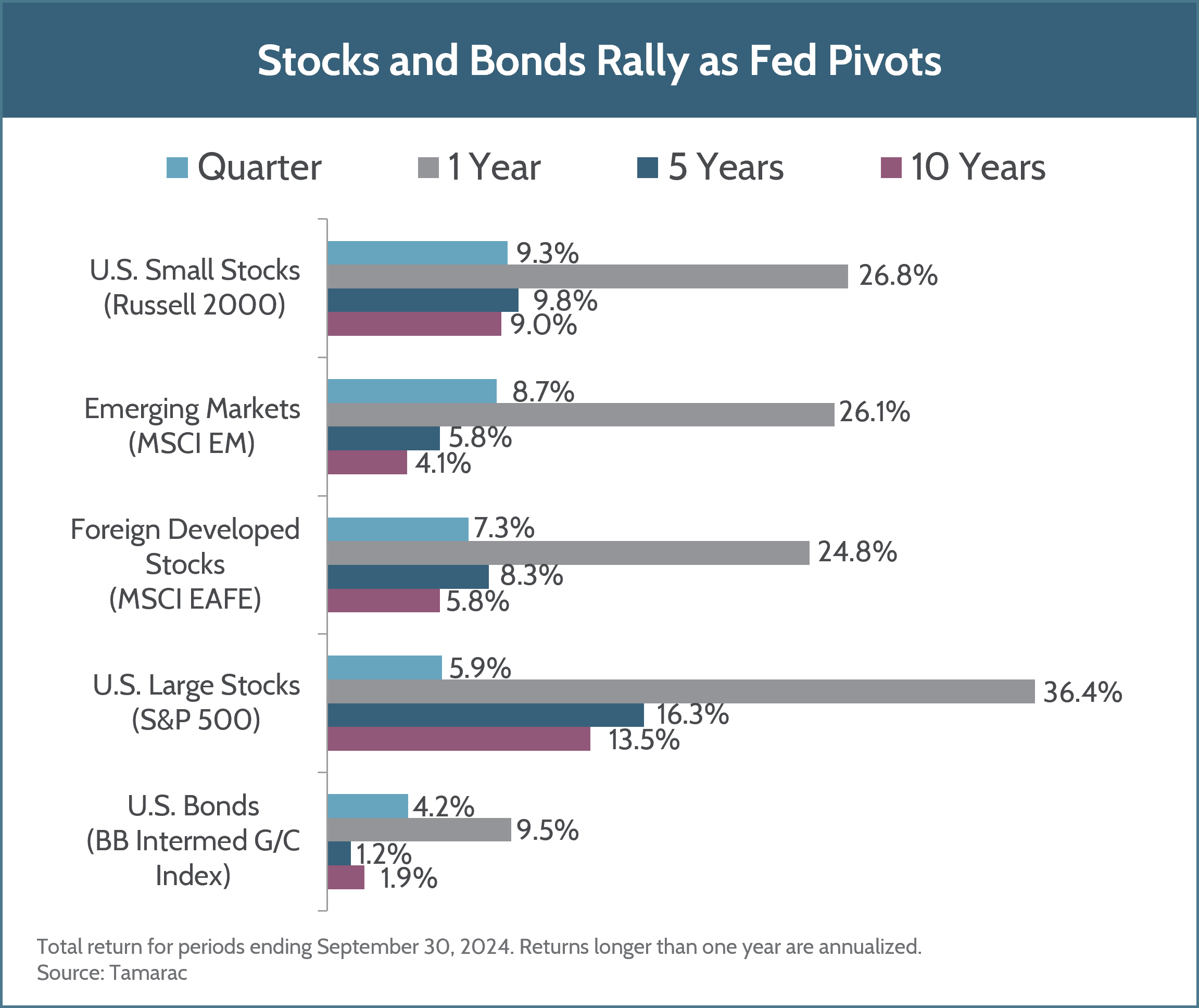

Stocks gained ground across the board as the Fed joined an increasing cohort of central banks easing policy across the globe. U.S. small-cap stocks posted the strongest returns of the quarter, up 9.3% due to expectations that a lower rate environment will help drive further profitability growth. China led the way in emerging markets, up over 23%, as the Chinese government injected stimulus into the economy over the third quarter to spur lending and investment in the country.

U.S. earnings and sales growth accelerated into the second quarter and exceeded expectations. Investors anticipate momentum to escalate through the fourth quarter of 2024, setting a relatively high bar for continued profitability growth.

The U.S. Economy remained on relatively solid footing, with second quarter real GDP growing at a 3% annualized rate and revisions to income showing that consumers’ disposable income and savings rates had been higher than initially measured. The U.S. labor market continued to normalize with hiring growth slowing, yet jobless claims, unemployment, and layoffs still holding to historically low levels.

After grinding higher for the first half of the year, bond yields fell in the third quarter as the Fed increasingly signaled the potential for rate cuts during the quarter, ultimately implementing a 0.5% cut in September. Bond prices rallied with the Fed’s pivot, up 4.2% over the quarter.

Outside of a volatility spike in August, caused by temporary concerns of a weakening U.S. economy that quickly abated, volatility throughout 2024 has been relatively muted. Volatility may rear its head as we move through the election season, but it’s important to remember that these events typically don’t drive extended changes in the economy or markets. (You can read more on election year volatility here.) Your Fulcrum team works to keep your long-term planning goals in mind while navigating short-term volatility and optimizing for opportunities in the market. We’re always here to answer questions and talk through your concerns; please don’t hesitate to reach out to your advisor.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, LLC, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators for a particular investment area, such as the S&P 500® Index serving as a way to gauge the performance of U.S. Large Stocks generally. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital, LLC is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.