October 9, 2023

Market Review: 3Q 2023

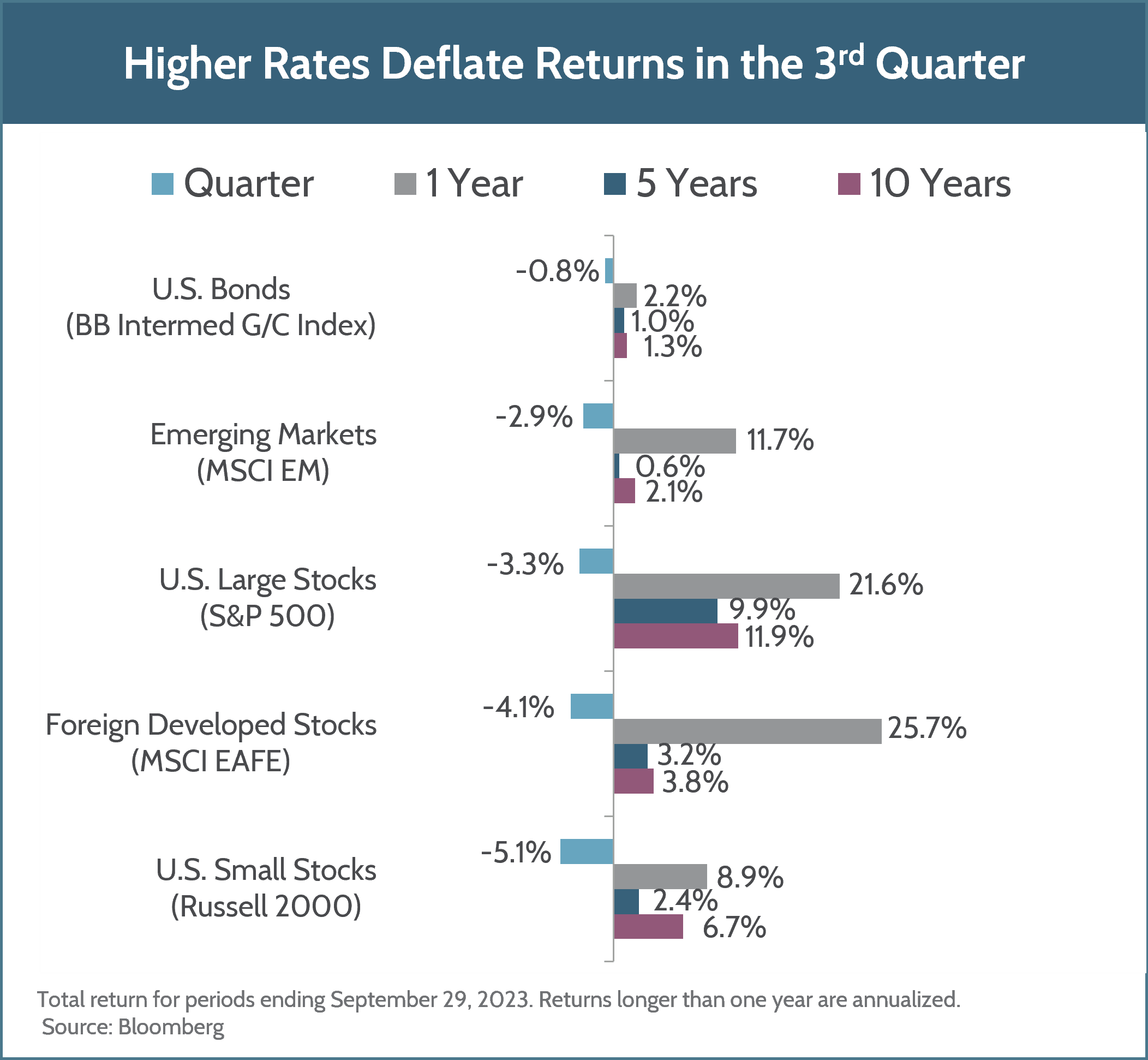

Stocks started off the third quarter on a positive note, as inflation in the US continued to decelerate and underlying indicators of economic growth held up better than expected. Hopes of a so-called “soft-landing” had perhaps peaked. US large cap stocks came within a few percentage points of all-time highs in July and even more economically sensitive asset classes, such as US small companies and emerging markets performed well as the rally across global stocks broadened. However, as we moved through the summer months, stocks reversed course and ended the quarter lower.

For US large cap stocks, which had been the primary area of strength for global stock markets so far this year, this reversal appeared to be due, at least in part, to the pressure of interest rates reaching heights not seen since the mid-2000s. Although corporate earnings continued to beat expectations and profit margins showed signs of improvement in 2023, the current rate environment compressed valuations. Continued earnings growth above expectations may be needed to mitigate valuation pressures created by a higher rate environment.

While the third quarter pullback in stocks was relatively modest, bond markets were unusually volatile. Interest rates across maturities headed higher as investors digested a lower probability of a recession and the likelihood that the Federal Reserve would hold short-term interest rates higher for longer. Intermediate and longer-term rates saw the largest increases, with the yield on the 10-year US Treasury note climbing 0.75% over the course of the quarter.

The dramatic rise in interest rates appears to be the product of a couple of factors: 1) Economic data continued to come in stronger than expected, and investors’ expectations are finally converging with the Fed’s ongoing rhetoric that rates will stay higher for longer, and 2) The US Treasury began funding deficits with longer dated notes and bonds. The increased supply, coupled with tepid demand (as many investors were already overweight bonds) contributed to yields marching steadily higher over the summer. The respite for bond investors in the first half of 2023 came to an end as bond values plumbed to new lows.

The Federal Reserve held rates steady in September, but the debate continues over how many more, if any, additional rate hikes we’ll see. Although various data points the Fed monitors closely have improved, such as labor market tightness and wage growth, there remains a risk that inflation could pick up again if the economy maintains momentum. The Fed is very attuned to the possibility of a second wave of inflation, which partly explains why investors are increasingly expecting a higher-for-longer rate environment.

Although the US economy continued to defy expectations, the economic growth picture abroad remains challenged. China, in particular, remains a concern as a weak recovery from zero COVID policies meets renewed worries of a property market meltdown. Although the Chinese government has supported the economy with lower borrowing rates and additional fiscal stimulus, Chinese consumers are still sitting on excess savings built up over the COVID lockdowns. Meanwhile, Europe has struggled with a weak manufacturing sector and persistent inflation. We expect a more tepid recovery across the majority of developed and emerging markets, but valuations are generally depressed and look attractive relative to the US.

Looking forward, ongoing political turmoil in the US may continue to cause market volatility in the fourth quarter of 2023 and into 2024. In our experience, however, these events rarely have a lasting impact on the economy or capital markets. Your advisor and the Fulcrum team are here to make the most of any opportunities while keeping your long-term planning goals in mind. Please reach out to your advisor if you have questions or concerns.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.