July 5, 2022

Market Review: 2Q 2022

by Hans Krippaehne

Financial markets remained volatile in the second quarter, making the first half of this year one of the most difficult in over 50 years. Renewed COVID lockdown measures in China as well as the ongoing war in Ukraine continue to disrupt supply chains. As a result, inflation remained elevated throughout the quarter. In response, the Federal Reserve has begun to tighten policy by both raising interest rates and reducing the size of its balance sheet.

The Fed’s increasing aggressiveness has led some pundits to express concerns about recession in the U.S. While the task of predicting recessions is complicated, many important measures of overall economic health, such as labor markets and consumer financial positions, remain robust.

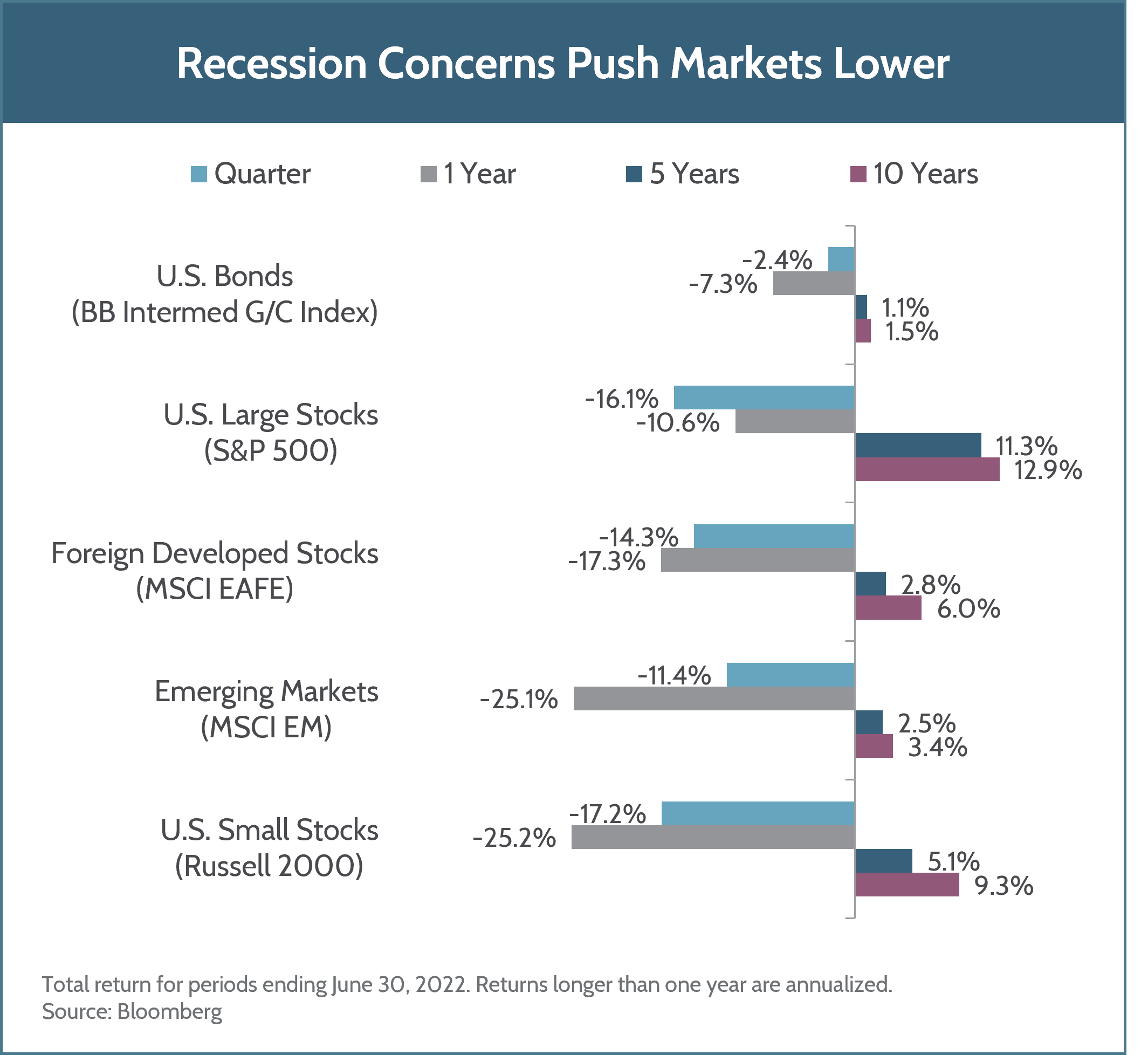

In the U.S., large cap stocks joined other major markets in entering bear market territory, defined as a 20% decline from recent highs. They are currently down about 21% so far this year, with more speculative growth stocks suffering the most. Small cap stocks, which tend to be more leveraged and reliant on capital markets for financing, fell even further than their large cap counterparts.

Foreign stocks also declined in the second quarter and have faced the headwind of a rising dollar for much of 2022. In foreign developed markets, concerns of an energy crisis and its potential impact on economic growth, particularly in Europe, have come to the fore. Emerging markets held up remarkably well, though they still lost around 11% in the second quarter. Within emerging markets, there were divergences in performance, primarily driven by whether the country is an exporter or importer of commodities, with exporters generally faring better. However, emerging markets remain vulnerable to volatile food and energy prices, as well as the broader global economic picture.

In the face of increasing inflation and a more aggressive Federal Reserve, interest rates across the maturity spectrum marched higher. This rising rate environment has been a significant headwind to bonds; so far this year, they have not provided the ballast investors have come to rely on in times of stock market stress. Bonds did hold up better than stocks, but not to the extent investors typically expect. The repricing of bonds has indeed been painful in the short term, though one silver lining is that forward looking returns and yields have improved.

Towards the end of the quarter, several of the contributing factors to inflation, such as scarce commodities (which have been one of the few asset classes with positive returns in 2022) and high global shipping rates, began to moderate. While perhaps too early to tell, this may be a nascent sign of cooling inflation. A more benign inflation picture may allow the Federal Reserve to be less aggressive in its policy going forward as well as give some reprieve to consumers, both in the U.S. and abroad. As we look forward, these factors may provide reason for optimism in the second half of 2022. Should inflation remain elevated, risks to global economic growth and firm profitability may emerge, resulting in continued market volatility.

Maintaining a diverse portfolio and a long-term perspective are essential in navigating this challenging market environment. It is our job to build client portfolios that can weather a range of outcomes while taking advantages of shorter-term opportunities. Please contact your advisor with any questions or concerns about current conditions and their impact on your plan.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.