April 2, 2025

Market Review: 1Q 2025

After a post-election rally late in 2024, the S&P 500 reversed course and came close to correction territory in the new year. Fear of consequences from potential policy changes drove the S&P 500’s dramatic decline of over 10% between February 19 and March 13, one of the fastest market corrections in the past century. Typically, a rapid correction more closely follows fundamental triggers like surprising economic reports, a banking crisis, or government defaults. This time, however, the sharp sell-off stemmed primarily from mounting investor anxiety around the potential aggressive trade policies proposed by the Trump administration. As policy uncertainty spiked to levels not seen since the pandemic, business and consumer confidence deteriorated and weighed on investor sentiment.

Even though consumer confidence fell dramatically over the quarter, the overall consumer picture held up relatively well. U.S. wage growth grew 4.1% year-over-year in February while inflation rose more modestly, up 2.8% (headline CPI). Unemployment remained close to historically low levels at 4.1% while job growth posted muted but positive gains in early 2025.

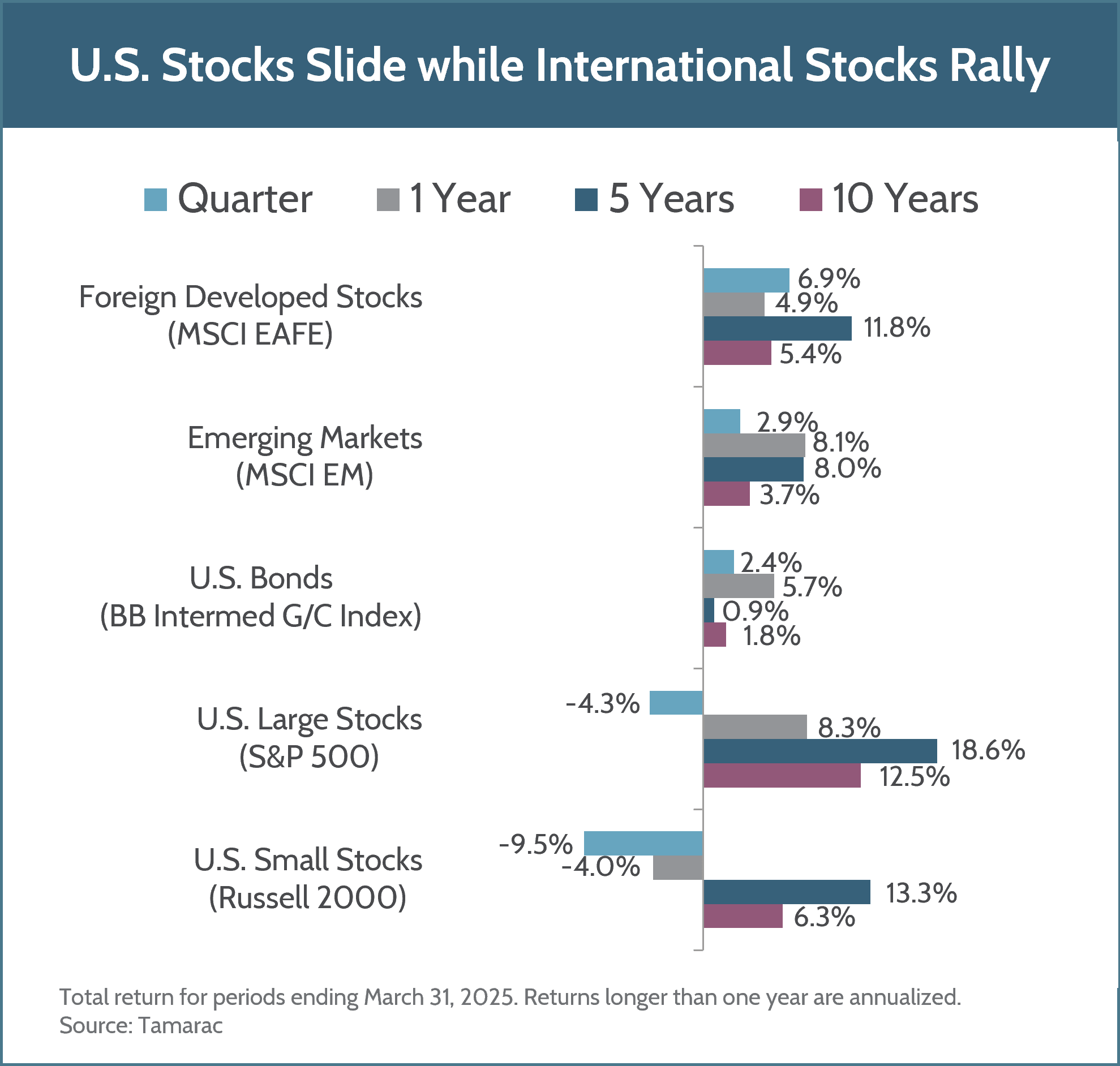

Although the S&P 500 briefly experienced a 10% drawdown early in the new year, the return for the full first quarter was less dire, falling 4.3%. Info tech was the biggest drag on S&P 500 returns for the quarter, down 12.7% in what has been one of the weakest first quarters on record for the sector—a stark reversal from 2024’s +36.6% return. As investors braced for potential policy implications impacting economic growth, small-cap stocks fell 9.5% over the quarter.

International developed and emerging markets were the bright spots in the global stock universe with international developed stocks up 6.9% and emerging market stocks up 2.9% over the quarter. With some signs of fundamental improvement in international economies as well as shifting government policies that are more accommodative, markets responded in kind. The U.S. dollar also weakened over the quarter, which helped boost foreign stock returns.

U.S. intermediate bonds delivered positive returns of 2.4% in the first quarter as investors sought safety in the risk-off environment. After cutting rates in December of last year, the Fed has signaled they will take a wait-and-see approach to rate changes as the economy digests the impacts of changes in trade and fiscal policy on growth and inflation.

We continue to monitor economic fundamentals as well as the impact of policy changes once they are implemented and clarified. Your Fulcrum team considers your long-term planning goals while looking for opportunities across the investment landscape. Please don’t hesitate to reach out to your advisor if you have any questions or concerns.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, LLC, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators for a particular investment area, such as the S&P 500® Index serving as a way to gauge the performance of U.S. Large Stocks generally. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital, LLC is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.