September 17, 2024

Gridlock Matters: Investment Implications of Election Outcomes

Over the summer of 2024, the political landscape changed dramatically when President Joe Biden decided to drop his reelection campaign and endorse current Vice President, Kamala Harris, for the 2024 Presidential race. As Harris and former President Donald Trump face off as contenders for President, we’ll examine some of the possible implications for investors.

In our earlier post, Decision 2024, we demonstrated that political outcomes aren’t a primary driver of investment results, and markets have historically done best under political gridlock. However, we do consider how policies may impact markets, industries, and individual stocks as part of our broader investment analysis. As we learn specifics from both parties, their recent communications and past records offer a general framework to guide our outlook.

In broad terms, both parties’ policies for taxes and spending are generally designed to promote growth, which delivers a positive backdrop for capital markets. However, their different stances on immigration, regulation, and trade require a more nuanced analysis.

As of early September, [1] their tax policies can be summarized as follows:

Democrats (Harris):

- Increase the corporate tax rate.

- Extend the 2017 Tax Cuts and Jobs Act (TJCA) for the middle class but increase tax rates for households earning over $400,000 per year.

- Eliminate income taxes on tips in services, gaming & hospitality.

- Expand the Child Tax Credit & Earned Income Tax Credit.

- Increase deductions for startup companies.

Republicans (Trump):

- Lower the corporate tax rate, favoring exporters over importers.

- Extend all 2017 (TJCA) tax cuts.

- Eliminate income taxes on tips in services, gaming & hospitality.

- Eliminate income taxes on Social Security benefits for seniors.

- Expand the Child Tax Credit

When it comes to spending, neither party shows interest in fiscal restraint. Indeed, Ned Davis Research estimates budget deficits could reach $220 to $650 billion per year under either administration.[2] This compounds high government spending from President Biden’s recent laws including the Inflation Reduction Act, the CHIPS Act, and the Infrastructure Investment and Jobs Act.

Any of these tax and spending policies will have to clear significant legislative hurdles. Both parties face tight Senate and House races, with polls showing no clear advantage outside the margin of error. Whoever wins is not likely to have a strong majority, making it challenging to enact sweeping changes.

As we explore the investment implications of these policies, we are mindful that market behavior is often counterintuitive. Even if an administration can pass new legislation, the eventual impact on the economy or markets may vary widely.

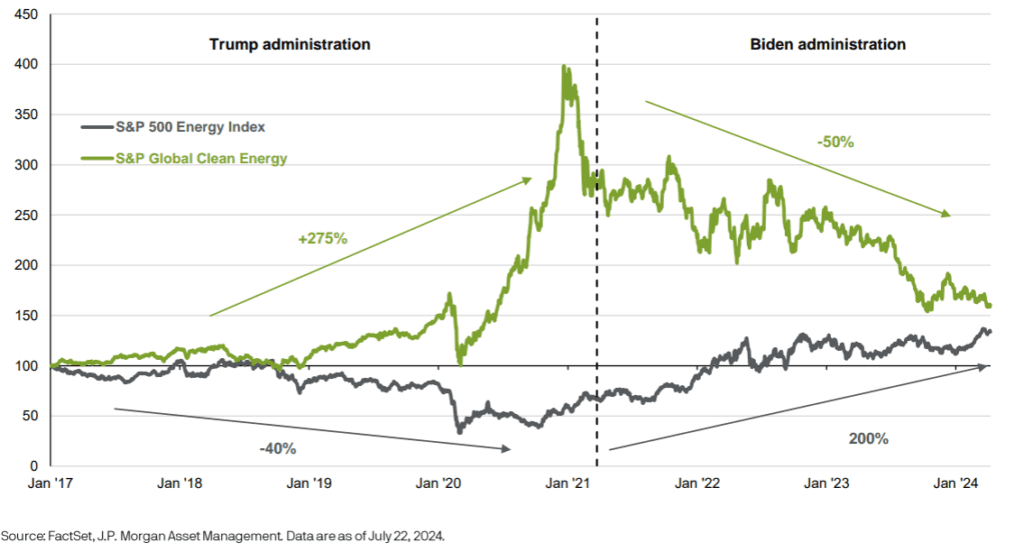

Clean vs traditional energy performance: Trump & Biden administrations

Government policies can have positive or negative effects on specific industries. However, broader economic factors often have a more significant and lasting influence. Trends in inflation, interest rates, and consumer behavior drive stock returns, often outweighing government policy changes.

For example, contrary to expectations, clean energy stocks rallied significantly over Trump’s 2016 term while traditional oil & gas stocks languished. Then, over most of Biden’s term, clean energy stocks subsequently lost steam, while traditional oil & gas stocks gained. In both cases, interest rates, inflation, and COVID dwarfed energy policy. During the Trump administration, low interest rates, low inflation, and Covid lockdowns drove energy prices lower. During the Biden administration, high inflation, rising interest rates, and an end to Covid lockdowns dominated. As the Federal Reserve continues to see progress on dissipating inflation, lower interest rates could once again provide a tailwind for both stocks and bonds.

Looking ahead, healthcare stands out as one of the sectors that may benefit most from current macro trends as well as a generally positive political backdrop. There has already been significant regulatory oversight over healthcare, which may lead to a more certain policy environment for healthcare companies looking forward. Democrats have made significant progress in lowering the prices of drugs for consumers through Medicaid and Medicare, which lowers the probability of future price caps. Meanwhile, Republicans are likely to focus spending cuts on discretionary social spending rather than health care spending.[3] Positive longer-term trends for health care include growing demand for care from aging baby boomers, new blockbuster drugs targeting cancers and obesity, and advancements in utilizing generative artificial intelligence to shorten the research and development phase for new drugs.[4]

While proposed tax and spending policy changes aren’t likely to inhibit growth if they do pass, trade and immigration policy changes, which are more at the discretion of the President and rely less on acts of Congress, can have an impact on growth. Trump has indicated a willingness to implement additional tariffs on imports to the U.S. from China, which may be a risk to industries like retailers and industrials if implemented, especially if combined with a border tax policy that favors U.S. exporters over importers. Immigration reforms may also constrain the supply of labor which could affect wages and supply chains.

Ultimately, the policy priorities of both parties are more closely aligned than the candidates’ personalities. Tight House and Senate races mean major changes will be unlikely to pass without bipartisan support. This generally moderates final legislation, moving it away from the extremes. From a market perspective, gridlock in Congress often serves as a feature, not a flaw, of our political system.

[1] Lazard. US Election Outlook. September, 2024.

[2] Ned David Research (NDR). Harris vs. Trump on the economy. August 27, 2024.

[3] BCA Research. Big Pharma: Early or Wrong. May 28, 2024.

[4] BCA Research. US Equities: What to select for the president elect. August 26, 2024.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, LLC, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital, LLC is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.