July 3, 2024

Market Review: 2Q 2024

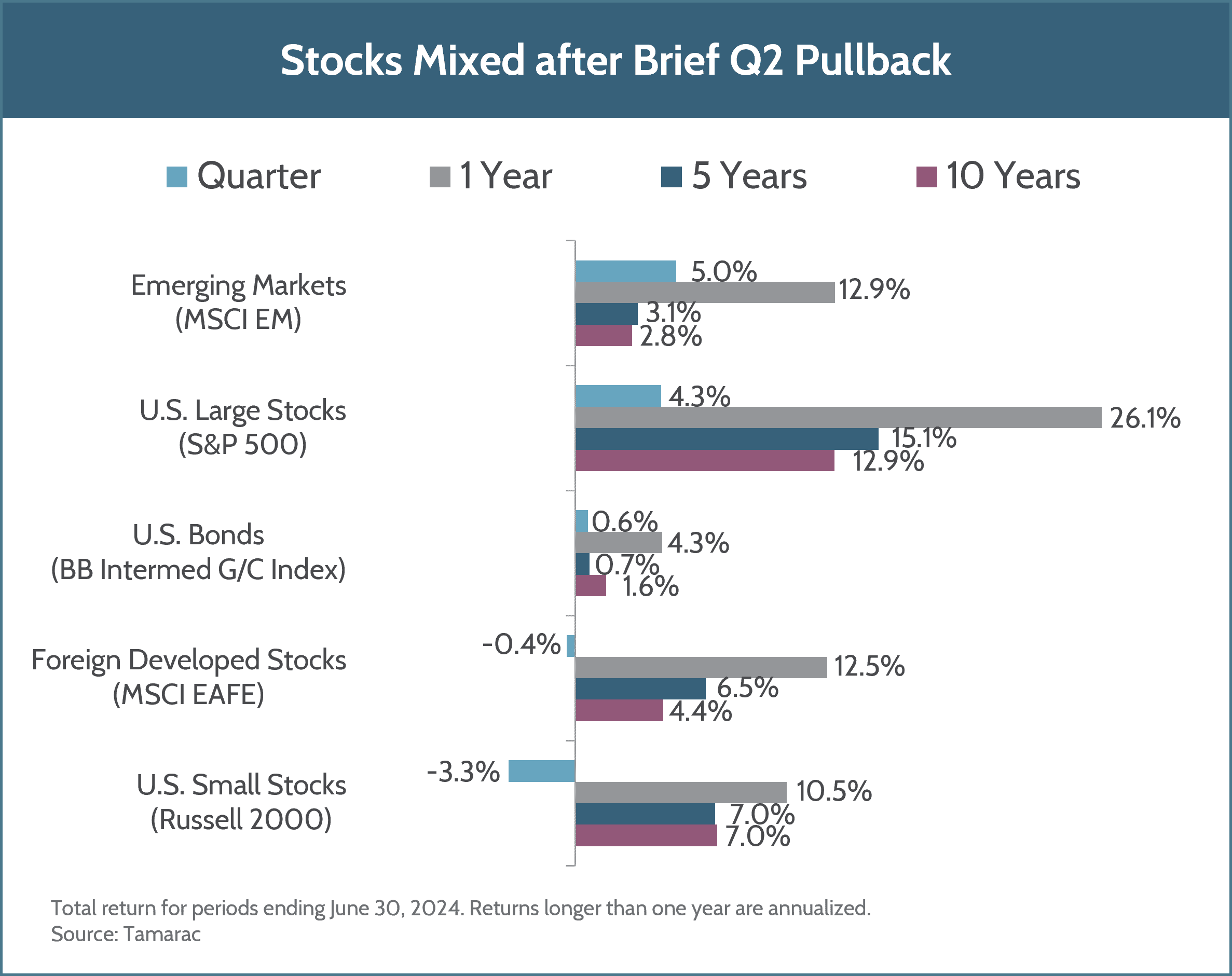

Stocks displayed resilience to higher interest rates in the first quarter of 2024, but a higher-than-expected inflation reading early in the second quarter precipitated a pullback across both stock and bond markets. The pullback ended up being fairly short-lived as subsequent data points suggested that the uptick in inflation would not turn into a larger trend. Interestingly, the recovery of various markets was uneven, with U.S. large company stocks and emerging market company stocks making new highs, while U.S. small company stocks and foreign developed large company stocks struggled for the remainder of the second quarter.

U.S. economic growth was a bit weaker than expected in the first quarter of 2024 following a strong finish to 2023. Nonetheless, given the ongoing uncertainty on the inflation front, hopes of significant rate cuts by the Federal Reserve were once again pushed out further into the future. As we entered 2024, market participants expected the Federal Reserve to cut rates a total of 6-7 times over the course of the year, but this has dramatically changed. Market expectations are now for just one rate cut in 2024, which coincidentally has converged with the Federal Reserve’s own estimate.

These conditions were a headwind for stocks of smaller companies, which are more sensitive to the overall economic environment and availability of capital. In fact, in the latest round of quarterly reports, sales, and profits for smaller companies in aggregate fell on a year over year basis, while for large companies they rose.

Turning abroad, the central bank picture is quite different. Several major foreign central banks have started to reduce interest rates. Recent notable actions were the European Central Bank and Bank of Canada cutting rates by 0.25%. Many central banks in emerging markets, which began increasing rates before the U.S. Federal Reserve at the first signs of sustained inflation, have also been the first to initiate rate cutting cycles.

Performance for emerging markets as a whole was strong in the second quarter, though varied underneath the hood. Asian countries such as India, China, and Taiwan were among stand out performers while certain Latin American countries, such as Brazil and Mexico posted declines.

The Eurozone economy looks to be emerging from a shallow recession. Profit growth that typically accompanies such conditions could be a tailwind for returns in the foreign developed category, which has lagged other stock markets so far in 2024.

Overall market volatility has remained muted in 2024 and analyst expectations for profit growth in the second half of the year are high. That combination, in concert with being an election year, could portend a bumpier ride through year-end. The Fulcrum Team continues to look for opportunities while maintaining a long-term perspective and keeping your goals in mind. Please don’t hesitate to reach out to your advisor if you have questions or concerns.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, LLC, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators for a particular investment area, such as the S&P 500® Index serving as a way to gauge the performance of U.S. Large Stocks generally. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital, LLC is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.