January 25, 2024

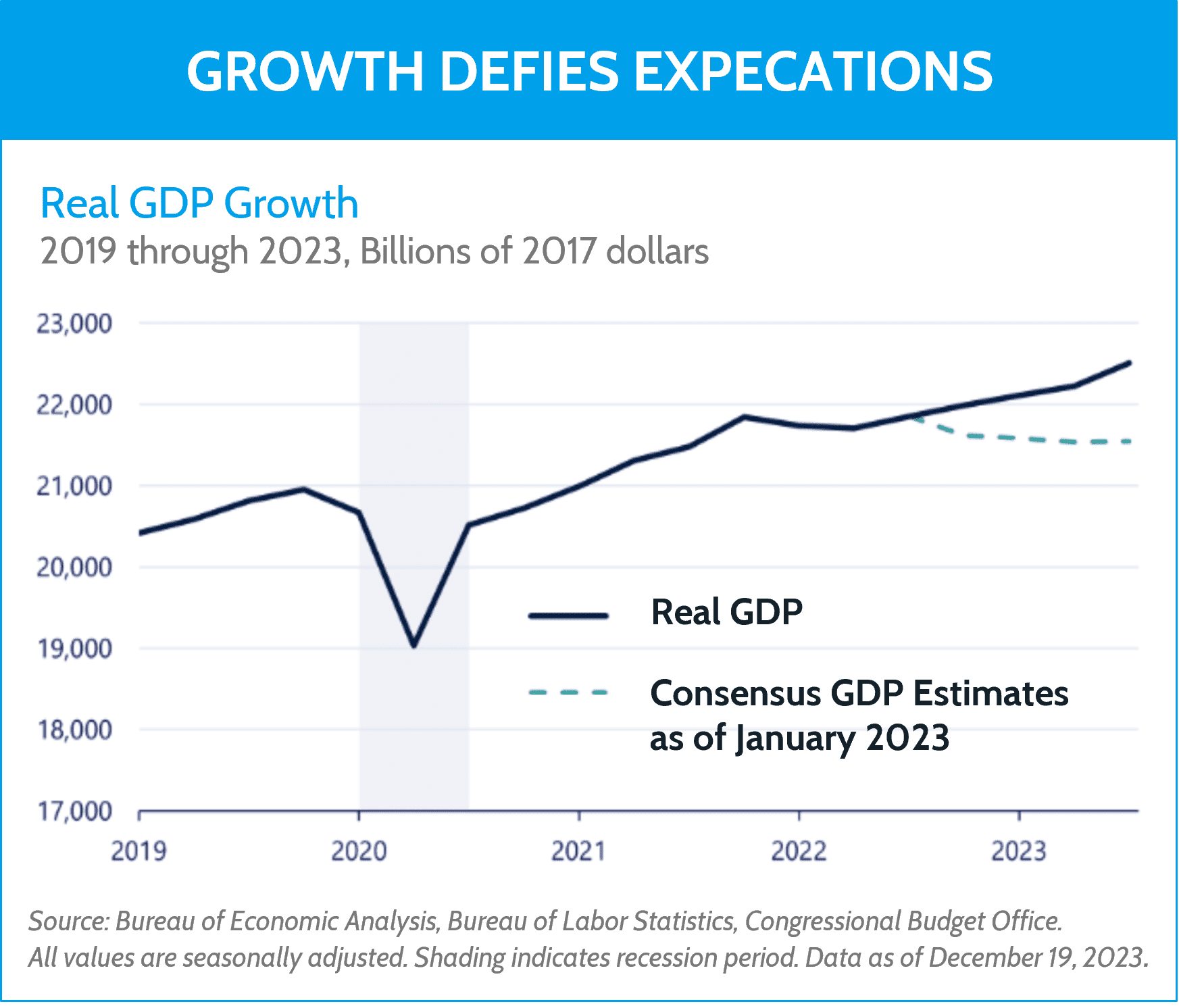

Reality Check: Will the economy continue to defy expectations in 2024?

How did so many forecasters, economists, and investors get the 2023 recession forecast so wrong? Several factors contributed to surprising growth. Consumers continued to spend pandemic savings, companies dodged high borrowing costs and hiked wages to retain employees, and government policies and spending bills stabilized troubled sectors of the economy. With supply chains improving and energy prices falling, inflation subsided without the accompanying economic weakness that many economists expected. Traditional metrics like leading economic indicators have been out of sync in the post-pandemic period, clouding the picture for forecasters even further.

Decelerating inflation and positive economic growth bolstered investor confidence, propelling markets upward over the past year. Four elements we believe will influence how long this positive backdrop persists:

- Consumers are sustaining spending as wages grow faster than inflation and household net worth is rising. Meanwhile, record low unemployment and elevated levels of job openings signal continued strength in the labor market. As we enter the new year, consumer confidence is rising at the fastest pace in 30 years. A healthy consumer and strong labor market are positive for economic growth.

- Corporations seemed to buy into economist’s forecasts of recession in 2023. Faced with an uncertain economic outlook and the dramatic rise in borrowing costs, companies cut costs and delayed investment. These measures are now starting to show up in profits, but companies need to play catch-up on forgone investments. Renewed investment activity should be a positive for economic growth, but higher capital spending and borrowing costs may pressure earnings.

- Lending conditions are tightening, which has both positive and negative effects. Tighter lending standards drag down economic activity, and high borrowing costs encourage more prudent investment decisions. Three factors have helped relieve some of the pressure. First, new facilities from the Federal Reserve in the wake of the regional banking troubles in the spring of 2023 have given banks breathing room. Second, the substantial decrease in interest rates in the fourth quarter helped repair balance sheets and confidence. Third, non-bank lenders such as private credit funds have entered the market in force and are attracting inflows that need to be committed to new loans. After over a year of caution, lenders are keen to lend. However, the expansion of credit in non-bank sectors deserves attention as these structures have not been tested by an extended economic contraction.

- Government policies on spending and interest rates also play a role. With a backdrop of lower inflation and stable employment, we expect the Federal Reserve to reduce short-term rates in 2024. The Fed Funds rate is currently more than 3% higher than core inflation, which affords plenty of room to cut. This will relieve the interest burden on borrowers, but investors should be careful what they wish for. While a few rate cuts to normalize policy relative to economic conditions are likely warranted and potentially beneficial, substantial rate cuts would imply a significant deterioration across the economy.

Meanwhile, U.S. government spending programs, which had increased somewhat prior to spiking during the pandemic, have continued at above-average levels. Fiscal stimulus has been a strong tailwind for consumers and corporations, and a significant reduction in government spending is unlikely in an election year. Most of this is debt-financed: $17 trillion of government debt is maturing in the next 18 months, much of it at interest rates significantly below current levels. Financing the growing pile of debt could pose challenges in 2024 and beyond as investors demand higher interest rates to compensate for the ever-growing debt load.

Overall, this paints a reasonably positive picture for the US economy in 2024. We believe the economy will grow at a sustainable and moderate pace, inflation will stabilize in the 2.5-3.0% range, and unemployment will remain low. Any slowdown or recession is likely to be mild, and the Federal Reserve has plenty of bandwidth to cut rates or provide back-door stimulus if the labor market or banking system starts to crack. One upside surprise that could extend the current cycle further is manufacturing, which has been in a slump for one of the longest periods on record. As excess inventories are beginning to clear, manufacturing could be a bright spot in 2024.

As we learned in 2023, reality can deviate from expectations for all sorts of reasons. The most obvious concern is that the full impact of the 5.25% hike in interest rates from May 2022 through July 2023 has yet to be fully felt. Borrowers who locked in lower interest rates have been insulated from the current higher-rate environment. Should interest rates remain close to current levels for an extended period, old loans will be replaced with new, more expensive loans, crowding out productive spending and driving asset valuations lower.

The path to low and stable inflation will not likely be smooth. With an economy operating near full capacity, it may not take much additional demand or a supply disruption to reignite inflation. A resurgence in inflation would dampen consumer sentiment and corporate profit expectations and limit the Federal Reserve’s willingness to lower rates. Other factors that cloud our outlook include the rising concentration of the US equity market in a handful of stocks, increasing antitrust regulations, escalating international conflicts, ongoing weakness in China, and messy politics. Including the US, roughly 40% of the globe has presidential elections this year. While domestic politics rarely have a lasting impact on markets, the inevitable headlines are bound to spark volatility.

We believe the economy – and our client portfolios – are resilient enough to withstand these pressures. After a strong performance in 2023 for both stocks and bonds, it is likely prudent to temper expectations going into 2024. As these dynamics play out, we expect there will be both good and bad times for investors this year. By centering our attention on long-term trends, we strive to filter out the noise and take advantage of price dislocations. Times of heightened market volatility allow us to bring added value to our clients by delivering clarity and confidence, reminding them to step back and focus on what really matters, and ensuring they have the capacity and stamina to stick to their long-term investment strategy.

Thank you for trusting us to guide you through the good and bad times. Our responsibility to our clients is always on our minds. Please reach out to your advisor to discuss your portfolio, your financial goals, or the markets in general. We are here to help you.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.