January 5, 2024

Market Review: 4Q 2023

Despite crosscurrents in the U.S. economy, 2023 was a year marked by stubborn resilience: a strong consumer willing to spend on the back of real income growth and excess savings, corporate earnings that defied expectations, a banking sector that avoided contagion, and a government that circumvented a series of shutdowns, even as political polarization continued.

U.S. real GDP growth barreled ahead in 2023 at an annualized pace of 5.2% in the 3rd quarter alone. Unemployment continued to sit near all-time historical lows at 3.7%, while we saw signs of a still tight but gradually cooling labor market. Although wage pressures eased and job openings fell, the U.S. economy still faced a tighter labor market than in the pre-pandemic era.

U.S. stock and bond markets also showed signs of support as the economy continued to beat expectations after a tumultuous 2022. US large-cap stocks rose 26% in 2023, just shy of all-time highs. With an explosion of interest in generative artificial intelligence, the technology-heavy Nasdaq composite index was up 44.8%. Bond markets also posted positive returns for the year. The Bloomberg Barclays Intermediate Government/Credit index was up 5.2% for 2023, starkly contrasting returns of -8.2% and -1.4% for 2022 and 2021, respectively.

While the economy continued to exhibit stronger than expected growth, energy prices ultimately provided a tailwind for falling inflation despite a challenging geo-political backdrop. Oil and gasoline fell in 2023, experiencing the largest fall in prices since 2020. Additionally, expectations of future inflation eased over the year as supply chains normalized and current inflation dissipated.

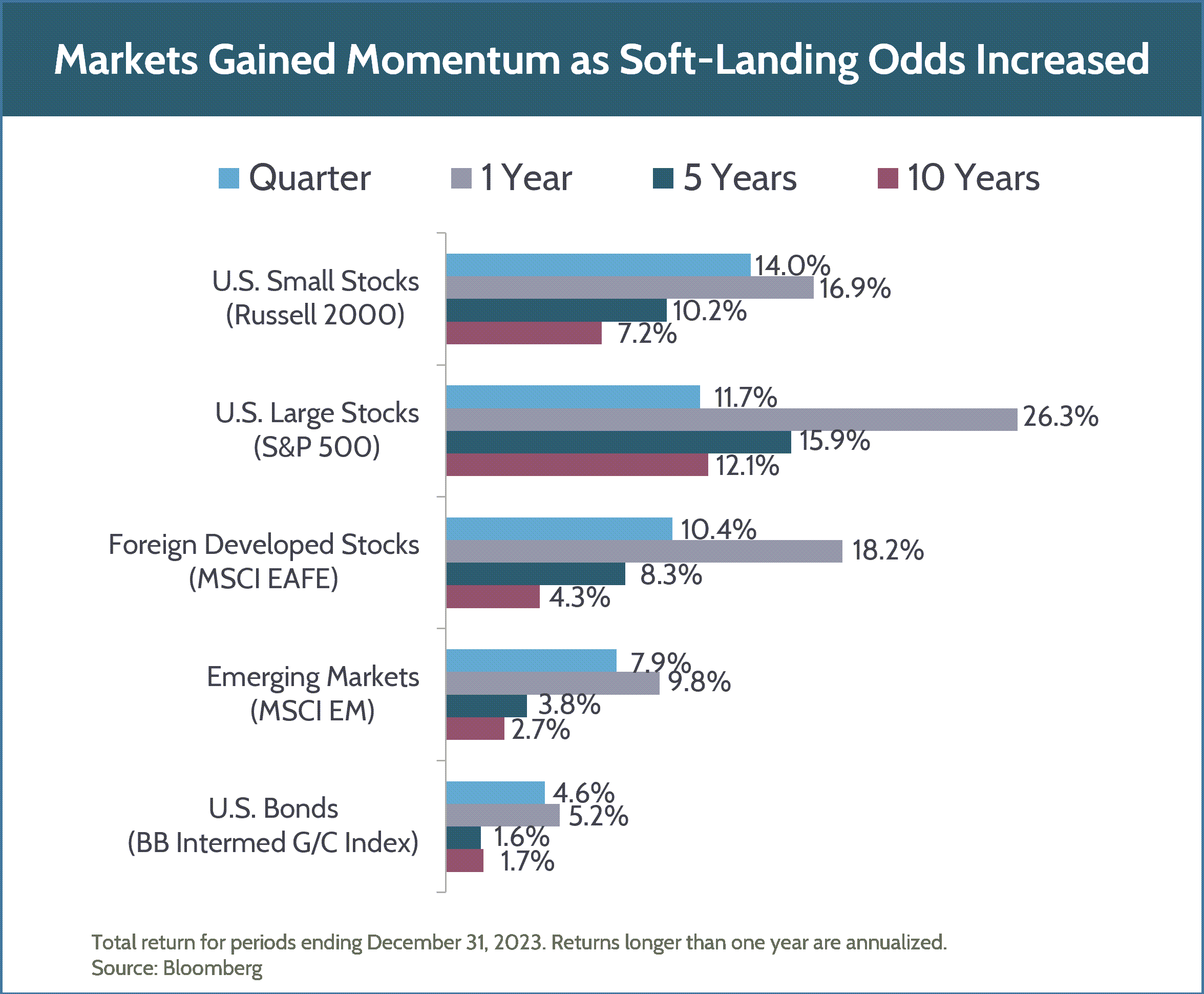

In the fourth quarter, better than expected inflationary prints led the Fed to signal potential rate cuts in 2024, sparking a rally in financial markets. The rally was initially concentrated in the largest U.S. Tech firms, then broadened to corporate high-yield debt, cryptocurrency, gold, and smaller-cap stocks as investors increasingly priced in the probability of a soft landing. U.S. large-cap stocks rose 11.7% during the last quarter of the year, while small-cap stocks posted the strongest results for the quarter, up 14%. 10-year Treasury yields fell 0.70% in the quarter, which drove the quarter’s bond returns up 4.6%, for the best quarter in over a decade.

Internationally, global central banks began to signal nearing the end of the hiking cycle which boosted international developed stocks, up 18.2% in 2023. Early in 2023, investors hoped that China’s re-opening would lead to outsized growth within the country, but a cautious Chinese consumer and an over-levered real estate sector led to muted growth relative to expectations. Even with China struggling, emerging market stocks grew 9.8% for the year overall.

As we start the clock in 2024, we believe inflation, interest rates, and corporate profitability will still be a significant driver of returns. We’re also entering an election year that could have significant policy implications for the U.S. 2024’s environment will likely create both challenges and opportunities. Maintaining a long-term view and focusing on high-quality, profitable businesses will help weather those challenges. The Fulcrum team continues to watch for opportunities as they arise while keeping your long-term planning goals in mind. Please reach out to your advisor if you have any questions or concerns.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.