July 3, 2023

Market Review: 2Q 2023

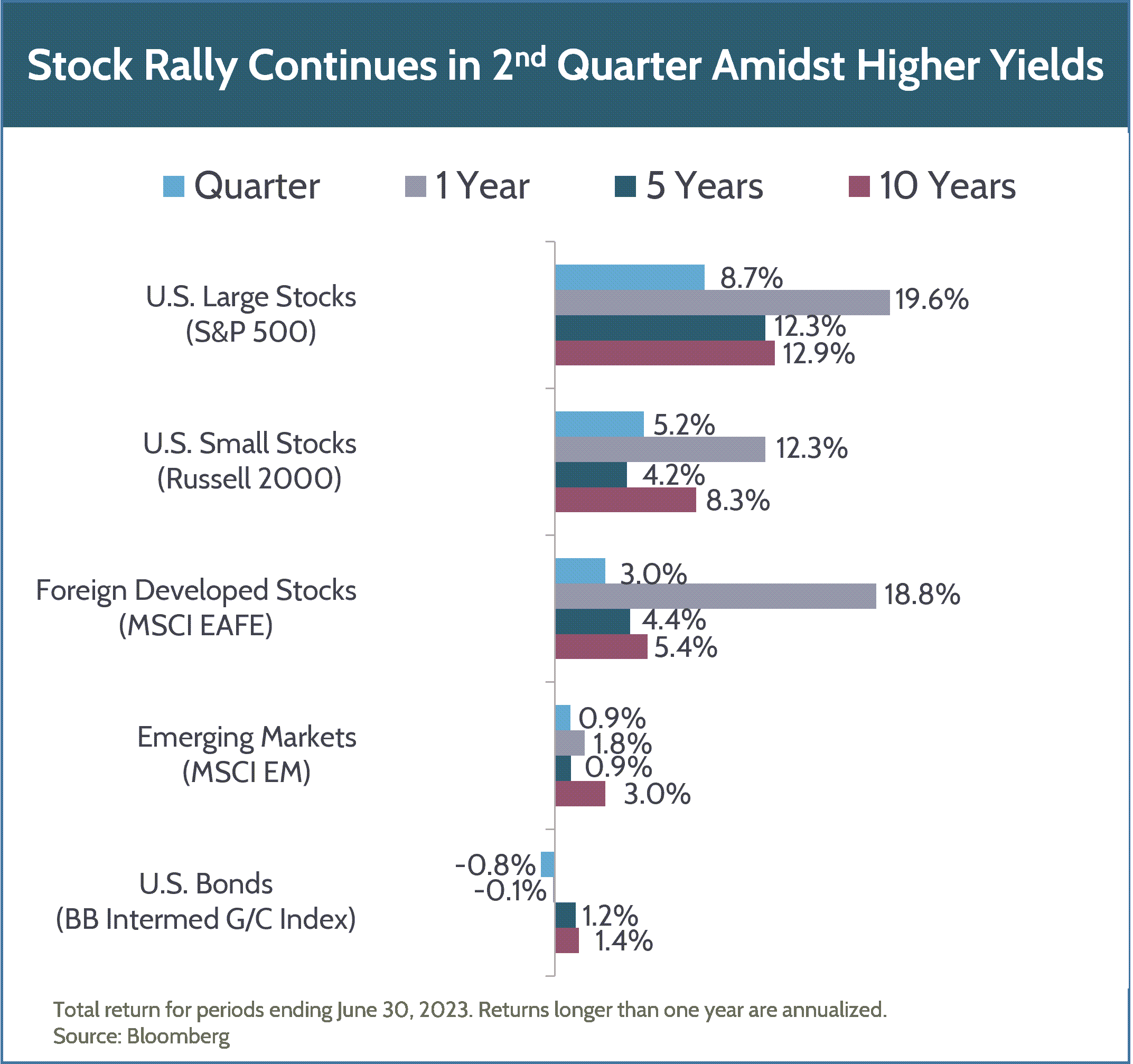

With both the banking and debt ceiling crises averted, and encouraging economic data suggesting a resilient US economy, stocks experienced strong growth over the second quarter. US large-cap stocks leaped forward 8.7% during the period and US small-cap stocks rallied 5.2%. Tech stocks primarily led the charge as the S&P 500 tech sector was up 17.2% for the quarter. Along with solid economic growth for the US, the allure of potentially game-changing productivity enhancements (not to mention the potential enhancements to corporate profitability growth) from generative artificial intelligence was also a significant contributor to higher stock prices. In the first half of the year, the tech-heavy Nasdaq index climbed 32.3% – its best first half in four decades.

US Consumers kept spending as real income growth expanded and job openings continued to be plentiful. Although a pick-up in layoffs is signaling some cracks, labor is still in a relatively strong position with a high number of job opportunities and elevated wage growth. On the back of expanding incomes, falling inflation, and a strong labor market, consumer sentiment also improved after being near historical lows for most of 2022.

US corporate earnings largely beat expectations for the second quarter and analysts expect to see profit growth in the second half of the year driven by expanding margins from lower costs. There are signs that input costs are falling as supply chains ease. This may provide relief to businesses that have been facing continuously increasing costs and may even help reverse the trend of shrinking margins over the coming quarters.

Foreign stocks also gained ground during the quarter, with developed markets up 3% and emerging markets up 0.9%. The US dollar strengthened over the quarter as the Fed’s more hawkish stance impacted currency markets, which in turn pressured foreign returns. Despite the stronger USD, foreign markets still delivered positive, albeit more muted, gains over the quarter.

Yields marched higher over the quarter as consensus expectations for a 2023 Fed pivot dissipated. This led to bond prices adjusting downward over the quarter, with intermediate-term US bonds down 0.8%. The fixed income markets are finally beginning to converge with the Fed’s communication that rates will be higher for longer. The Fed continues to reiterate its goal of pushing inflation down to 2%. Though we’ve seen incredible progress towards that 2% target over the past year, inflation still appears to be sticky in the services sector. Although the Fed paused its rate hiking cycle in June, they indicated that further hikes could be on the way as they work towards their longer-term inflationary goals.

Despite the fixed income market reflecting expectations of higher interest rates for an extended period, stock valuations climbed higher. Generally, changes in bond yields have exhibited an inverse relationship with stock valuations, but this quarter was an anomaly, with both rates and stock valuations moving higher. This may indicate the market’s hope that a soft landing is possible even if we see additional rate hikes, given the continued strength of the US economy.

At Fulcrum, we focus on businesses that can navigate a range of outcomes. Our job is to maintain a well-diversified portfolio and long-term perspective while seeking to take advantage of short-term opportunities. Please contact your advisor with any questions or concerns about the markets and their impact on your plan.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.