April 3, 2023

Market Review: 1Q 2023

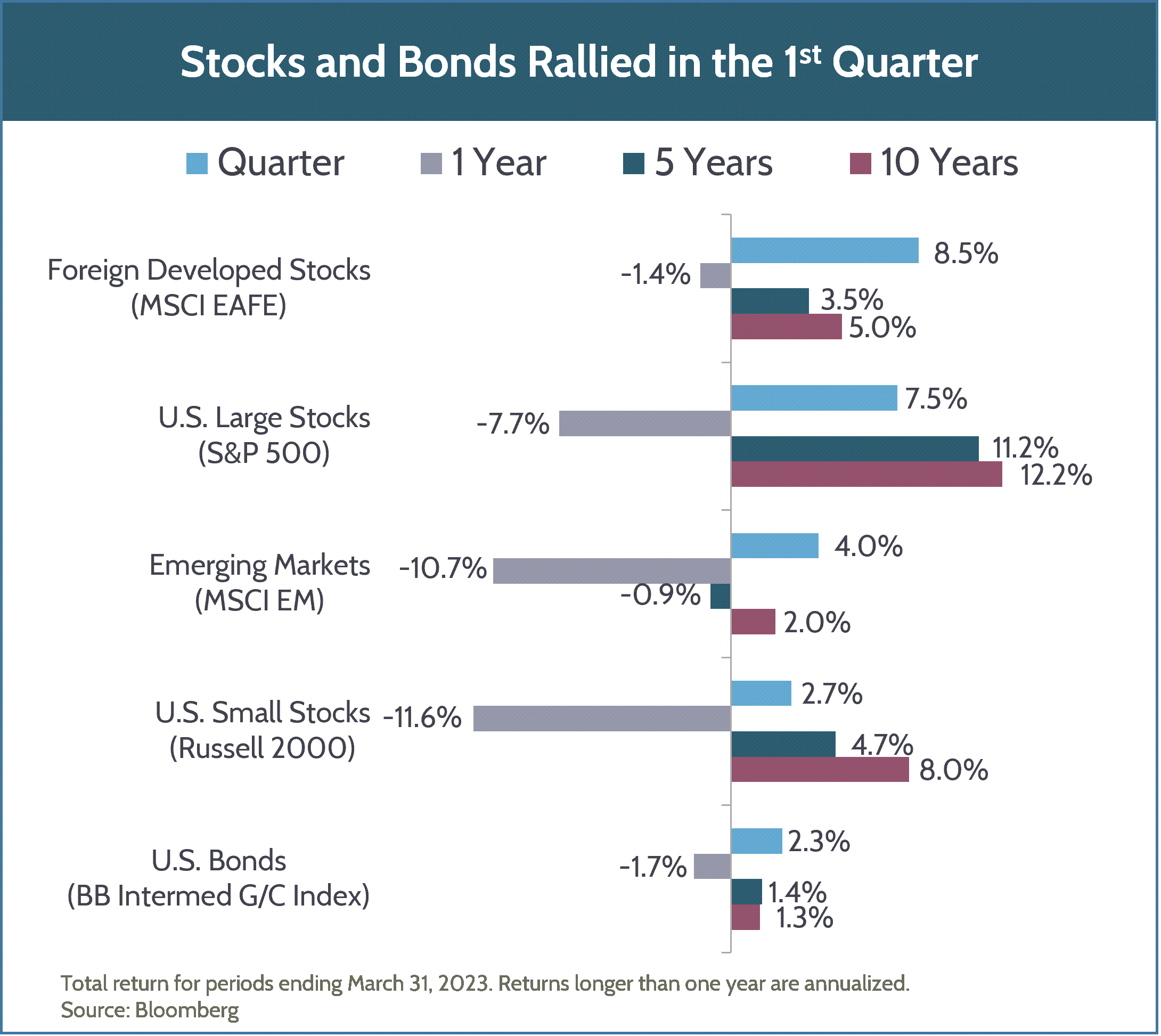

Changes in interest rates were the major driver of both stock and bond markets during the first quarter of 2023. On the back of expectations that the Federal Reserve is close to ending its tightening cycle, stocks across the globe delivered strong returns with international developed markets up 8.5%, US markets up 7.5%, and emerging markets up 4%. Bond markets also experienced a strong quarter, with intermediate term US bonds up 2.3%. Growth stocks outperformed value stocks by over 4% percent as valuations for growth names were buoyed by falling interest rates. The first quarter of 2023 represents a reverse of 2022; growth stocks which were decimated last year are experiencing the strongest rebound in 2023, and energy stocks which were up over 60% last year are down year-to-date. The recession fears that gripped investors for much of 2022 seemed to recede and although that risk remains on the horizon, short-term optimism has helped push markets higher.

March’s bank failures were precipitated by concerns that some mid-sized banks would be unable to fulfill their deposit obligations. The Federal Reserve worked in concert with the US Treasury and the FDIC to assure access to uninsured deposits at the failing banks and support banks in meeting deposit withdrawals. In the midst of this heightened volatility in both stock and bond markets and fears of a broader fallout across the financial sector, the Fed increased the Fed Funds rate an additional 0.25% in March. Some investors expected the Federal Reserve to pause rate hikes given the bank failures, but the Fed continues to signal that price stability and an inflation target of 2% are still their paramount objectives.

The fixed income futures markets are at odds with the Fed’s guidance that it will continue its path of restrictive interest rate policy. Short-term bond futures are betting that the Fed will start lowering rates in the second half of the year. Investors anticipate that the bank failures will lead to tighter lending standards, less loan growth, and less access to credit which will further slow the economy and decrease the Fed’s need to raise rates further.

The challenge for the Fed is that inflation, while slowing from a peak rate of 8.9% in June of last year down to 6.0% this February, is still persistent. Shelter costs continue to run hot and, although wages have started to cool as the labor market loses steam, unemployment is close to historical lows and the mismatch between job openings and job seekers is startlingly high.

US corporate profitability fell in the last quarter of 2022, with operating earnings down 6% for 2022. Rising costs due to supply chain issues, continued strength in the labor market, and rising interest rates have all contributed to a fall in earnings and margins. Expectations for earnings growth in 2023 have been revised downward to nearly zero. Those corporations that have pricing power and can pass along increased costs and maintain margins will fare best in the current environment.

Turning abroad, the main story of the first quarter was the reopening of the Chinese economy following restrictive COVID policies. Though met with more of a whimper than a bang by financial markets, it represents a tailwind for both developed and emerging economies in the coming quarters as economic activity recovers.

So far, 2023 has been a welcome reprieve from 2022, with both stock and bond markets staging a recovery. And although inflation risk appears to be receding slowly, new risks have materialized in the banking sector which pose potential risks to economic growth. This dynamic environment creates both risk and opportunity. We believe maintaining a long-term view with an eye toward high-quality, profitable businesses should help us capitalize on such opportunities as they arise. Your advisor and the whole Fulcrum team are here to make the most of those opportunities while keeping your long-term planning goals in mind. Please reach out to your advisor if you have questions or concerns.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.