October 6, 2022

Market Review: 3Q 2022

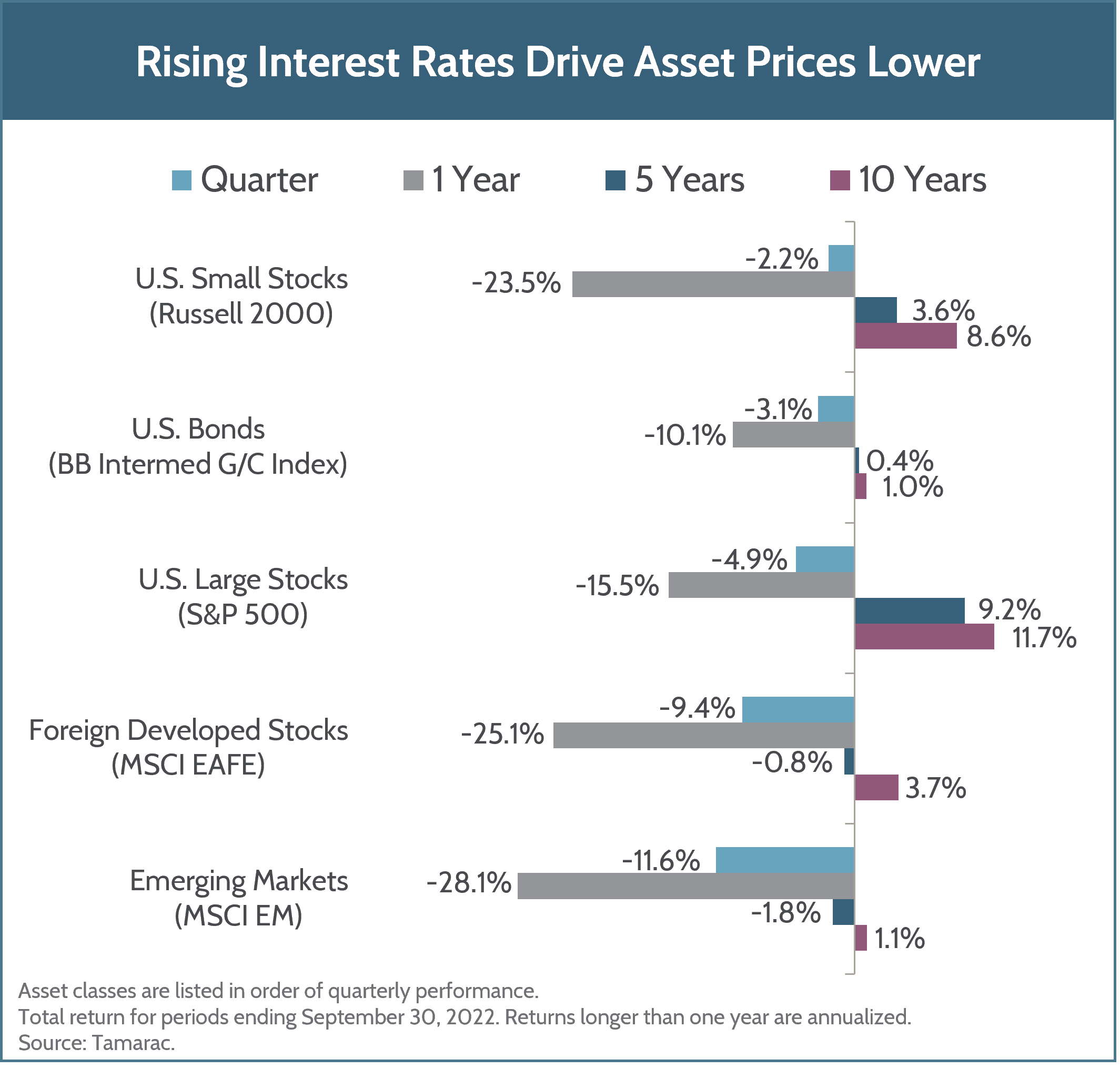

After staging a significant rally at the beginning of the quarter, stocks rolled over and continued on the downward trajectory that started back in January. Optimism surrounding falling commodity prices and a better-than-expected second quarter earnings season faded as inflation remained stubbornly high, prompting the Federal Reserve to continue its mission to rein in inflation. Markets abroad reflected less optimism as investors remained cautious about the energy picture heading into the fall and winter months. Nevertheless, with few exceptions, central banks around the globe remain committed to raising rates to combat inflation.

The broad domestic economic picture remains cloudy. Although economic growth is slowing following the rapid recovery from the COVID-induced recession, labor markets remain resilient, helping US households mitigate the effects of inflation. The effects of the Fed’s rate increases on the economy have not yet been fully felt, but interest rate sensitive segments of the economy, such as housing, are cooling.

With rates on the rise and inflation remaining elevated, US stocks have been unable to sustain a rally. However, the majority of the decline in stock prices this year is due to falling valuations rather than declining earnings, leaving valuations below average compared to the past few decades. Interestingly, small cap stocks outperformed their large cap counterparts in the quarter. Investor optimism regarding these smaller companies, which are more sensitive to the overall economic environment, may be a signal of brighter times ahead.

Looking abroad, the relentless rise of the US dollar continued to be a headwind to foreign returns, with foreign stocks underperforming domestic stocks. Elevated energy prices remain a risk for foreign countries and could very well push European countries into recession. In China, the zero COVID policy is creating a stop-start environment, which has hindered economic growth. The weakness is a double-edged sword as it has also kept inflation at bay, allowing both fiscal and monetary policy to be more accommodative.

Interest rates continued to rise across the maturity spectrum, with shorter term rates rising more than longer term rates as investors shifted expectations to a longer and more aggressive central bank tightening cycle. This environment made for another painful quarter in bond markets, piling further damage on one of the severest bond markets in decades and contributing to the worst January through September performance for balanced investors in a 60% stock, 40% bond portfolio since 1974.

Looking forward, two key elements to watch are inflation and earnings. Moderating inflation would allow central banks to be less aggressive in raising interest rates, potentially allowing market participants to become more bullish. On the earnings front, deterioration due to a recession has not been priced in and could result in further downside for stock markets. On the flip side, analysts have revised their earnings expectations lower over the last quarter, and a strong earnings season could also shift the tide of investor sentiment.

With the stock market pivoting dramatically every few weeks, timing the market is more likely to work against you rather than in your favor. It’s critical to stay invested and maintain a long-term focus amidst such significant volatility. This year has ushered in dramatic price declines across nearly every asset class. We believe this generally leads to better forward-looking returns as valuations are more attractive, but there are still risks of further downside in the short term if economic conditions deteriorate. Fulcrum’s core focus remains on high-quality, profitable companies that are well positioned to weather the current economic environment thanks to strong balance sheets and strong cash flows. Maintaining a quality investment framework along with a long-term perspective is essential to successfully navigating this challenging market environment. As always, we are here to help you through this challenging period. Your advisor can help you analyze the impact of this year’s volatility on your long-term financial picture and determine whether there may be opportunities for you to take advantage of in these volatile times.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.