June 15, 2018

TOO MUCH OF A GOOD THING

Many investors see portfolio diversification as an almost magical strategy that reduces risk and ensures solid returns. In reality, diversification is similar to a dietary supplement: beneficial up to a point, but actually harmful in extreme doses.

Consider a person who overloads on vitamins and minerals. The excesses are not absorbed into the system and can create serious health issues. Too much Vitamin C, for example, can cause stomach cramps and nausea, and too much Vitamin D can lead to kidney problems.

Over three decades of managing money, we have seen countless portfolios that have too many “vitamins”—dozens of stocks, bonds, mutual funds and index funds, along with more esoteric asset classes like managed futures and structured credit—all in the pursuit of diversification. These funds often contain tiny fractions of hundreds or thousands of securities that can overlap or offset each other: One fund may be underweight technology, and another overweight technology. Everything is diluted so much that the best result these investors can hope to achieve is average, with unnecessary layers of costs.

"Just as excess vitamins won’t help your body, excess diversification won’t help your investment returns."

Reducing Risk, Or Just Reducing Rewards?

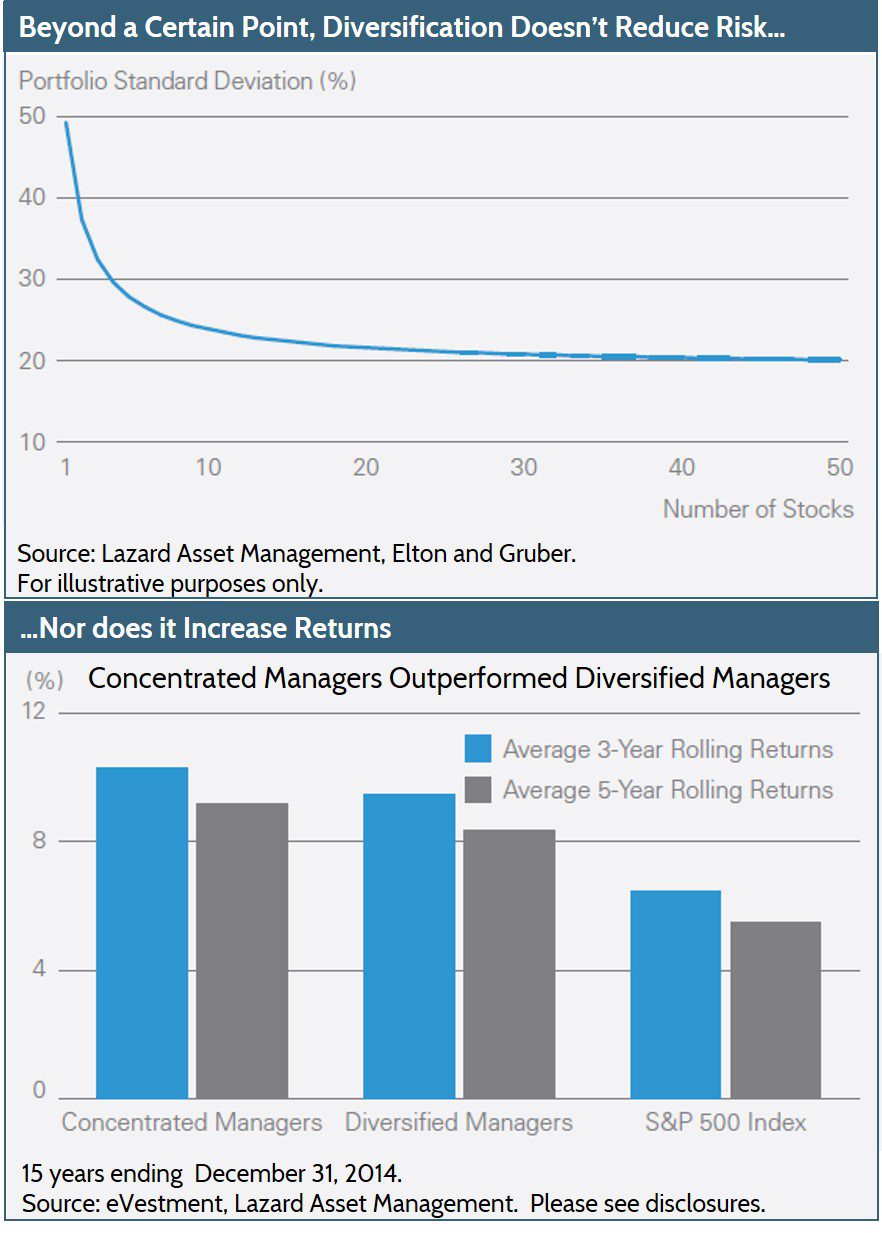

There is a point at which adding more stocks to a portfolio doesn’t meaningfully reduce risk—but it does reduce your potential rewards (see charts below).[i] Generally speaking, a portfolio of 30-50 individual stocks accomplishes almost all the risk-reduction benefits of a diversified stock index. Indeed, evidence shows that investors sacrifice returns in the pursuit of diversification. A 2005 study in the Journal of Finance found that less-diversified funds had better performance than more diversified funds, even on a risk-adjusted basis.[ii] Another study in 2015 found that concentrated global investment strategies can outperform because managers have an information advantage and economies of scale.[iii]

Average Isn’t Acceptable

Of course, the theory of diversification is perfectly reasonable: When one part of a portfolio zigs and another zags, overall risk is reduced. This is true. But instead of increasing your potential return, reducing risk really only serves one purpose: it makes it more likely that you’ll earn the average expected return. What’s wrong with that? Isn’t it better to be average than below average? Sure, if it really worked that way—but it usually doesn’t. Here’s why:

Diversification doesn’t always have the intended effect. In a crisis, securities tend to zig in the same direction: For example, global stocks, commodities, bonds and hedge funds all suffered double-digit losses in 2008. To use industry jargon, correlations tend to rise toward 1.0 when markets are stressed.

Diversification is not alchemy. No matter how you dice it, ground chuck steak will never become a juicy filet mignon. (In the book “The Big Short,” Michael Lewis does a fantastic job of explaining how this misconception factored into the financial crisis of 2008.) If an index or fund includes lots of different lousy investments, you’ll end up with lousy returns. To be sure, it’s really, really difficult to identify good-quality investments. It’s hard enough to choose one best-in-class fund or manager, much less four, five, 10 or more! By investing in thousands of securities, what these advisors are really doing is abdicating their responsibility to make good investment decisions.

“Average” is not necessarily the right target for everyone. In fact, it’s the wrong target for many people. Rather than overdosing on things you don’t need or want; wouldn’t you prefer a custom-tailored multivitamin that complements your natural diet and lifestyle—especially if it was available to you at a reasonable price? That’s what the right investment advisor can do for your fiscal health.

" If you are a know-something investor, able to understand business economics… conventional diversification makes no sense for you. It is apt simply to hurt your results and increase your risk."

Warren Buffet, 1993 Berkshire Hathaway Shareholder Letter

Know What you Own

At Fulcrum, our clients are investing with a long time horizon, which affords them both the capacity and temperament to withstand more concentration in the growth engine of their portfolios—that is, to take on more risk. Returns are the reward for that risk. While there can be no guarantees, as your advisor, our job is to know your exposures and ensure you are compensated accordingly.

In addition to avoiding the extra layer of embedded fees in funds, a core portfolio of individual stocks and bonds can offer greater tax efficiency than index funds or actively managed funds. We construct portfolios to target the highest after-tax income for each client on a security-by-security basis, and we actively harvest gains or losses throughout the year. The range of winners and losers gives us tremendous flexibility. For example, when gifting appreciated securities to charity, the tax benefit is much more valuable from gifting a single stock that has 80% embedded gains than from gifting a diversified fund that has just 20% embedded gains! The out-of-pocket cost of that gift is a fraction of the donated value.

We also believe using so-called “hedge strategies” to reduce risk is unnecessarily complex and expensive. Rather, cash, stocks and bonds offer plenty of inexpensive and effective diversification benefits to portfolios. When we employ alternative or opportunistic investments, we generally do so in an attempt to increase expected returns, not to reduce risk.

For example, we typically complement our core portfolio of 30-45 individual stocks and 10-20 individual bonds with low-cost funds or ETFs that invest in foreign stocks, private real estate, and other asset classes. These exposures are intended to capture excess returns beyond the core individual securities. If they deliver additional diversification benefits, that’s simply frosting on top.

"We invest in high-quality, sustainable, and growing companies where we anticipate our clients will be sharing in the financial success of these great businesses for many years to come.."

Bob Kuehn, Co-Founder, Fulcrum Capital

Rather than hiring and firing managers every few years, we have the patience, independence and experience to endure full market cycles. We have a deep appreciation for risk management, not a blind devotion to diversification. Our rigorous investment process for selecting securities is driven by our strong understanding of and conviction in the companies and managers we invest in. That conviction would be diluted by unnecessary diversification.

In the end, the Fulcrum approach strives to maximize returns by allowing clients to share in the anticipated financial success of these great businesses for many years to come.

[i] Lazard Asset Management, 2015, “Less Is More: A Case for Concentrated Portfolios.” Return data are based on the eVestment US All Cap, Large Cap, Mid Cap, Small-Mid Cap, and Small Cap Equity Universes, composed of 223 concentrated strategies and 2,029 diversified strategies with a reported number of holdings as reported on 10 February 2015. US Concentrated managers are those strategies with 30 or fewer holdings as of the reporting date. Diversified managers are those with more than 30 holdings. For illustrative purposes only.

[ii] Kazperczyk, Sialm, Zheng, 2005, “On the Industry Concentration of Actively Managed Equity Mutual Funds,” Journal of Finance, 1983-2002

[iii] [iii] Choi, Fedenia, Skiba, Sokolyk, 2015, “Portfolio Concentration and Performance of Institutional Investors Worldwide”

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.