2022 Outlook

January 2022

A downloadable PDF version may be accessed by clicking this link.

Markets

Brace for market volatility driven by rising interest rates, political uncertainty, and above-average valuations.

With interest rates moving higher, future bond market returns will be challenged, especially for longer-term bonds. We prefer intermediate-term bonds, high yield bonds, core real estate, and private credit in this environment.

Corporations and households are flush with cash. Excess savings and strong balance sheets give us comfort that the economic recovery has legs. We expect global real GDP of 4.5% in 2022, more than 1% above trend.

Oil markets will likely remain strong as years of underinvestment leads to a lack of supply, which leads to higher prices.

Foreign developed economies are well positioned relative to the U.S. as the European Central Bank and regional governments remain accommodative. Labor and inflation are also less of an issue. We expect foreign developed stocks to finally have their day in the sun, outperforming the U.S. market in 2022.

Emerging markets will fare well in 2022 given the low price point for stocks in this category. Although Chinese markets do present value, we are cautious in allocating to the region due to unpredictable policy.

The principal risks to our outlook are a) the extended effects of a slowdown in China and b) inflation remaining stubbornly high, forcing the Fed and other central banks to raise interest rates too much or too quickly.

Policy

U.S. fiscal and monetary policy to tighten. U.S. budget deficit to materially shrink; Federal Reserve to commence interest rate hikes as of March 2022, with four rate hikes expected in 2022.

Continental Europe and China governments and central banks remain accommodative despite the Federal Reserve’s pivot.

U.S. mid-term elections will likely result in a Republican House and, possibly, Senate in November. Passing a large spending package such as Build Back Better will be a challenge.

Tensions between the West and Russia and China will drive volatility, but a full-scale war is highly unlikely.

European reliance on Russian natural gas and exports to China may result in the E.U. moving away from the U.S. on foreign policy.

Post-COVID Investment Themes

Global real interest rates will remain close to zero, supporting higher valuations for risky, long-duration assets like growth stocks and real estate.

Dominant companies will grow more dominant until, at some point, less competition leads to rising anti-trust penalties and break-ups.

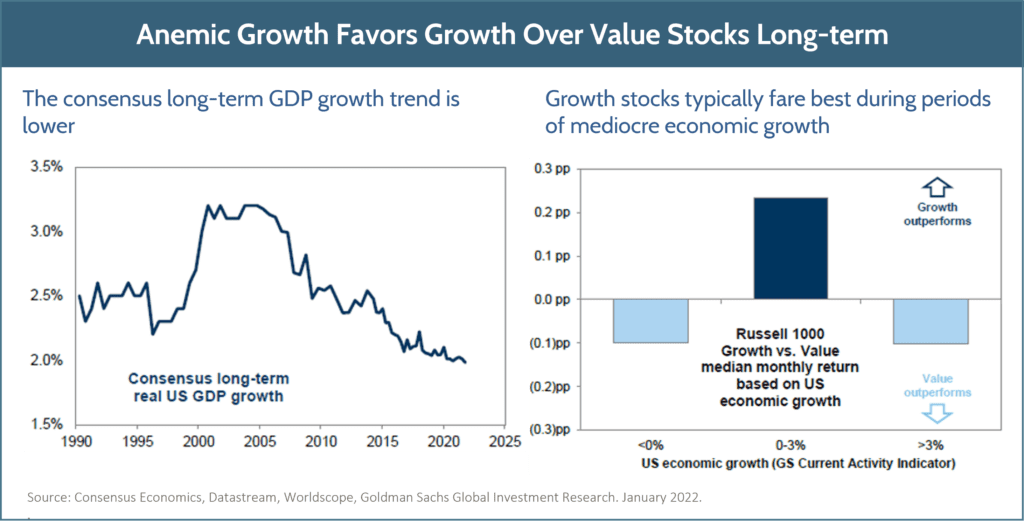

Anemic global growth will be the norm over the medium-term driven by demographics, higher sovereign debt, and monetary policy ineptness.

Digital transformation accelerated by the pandemic will continue to drive structural changes in the global economy, raising living standards and productivity growth.

Income and wealth inequality persist and likely worsen, driving political divisiveness and populism.

Colossal sovereign debt and deficits will continue. Taxes will likely move higher across the world in the medium-term, while aging demographics, productivity improvements, and slow growth keep a lid on inflation.

This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This communication is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. This information is subject to change without notice. Fulcrum Capital is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.